• EUR/NZD declined on Monday after PMI data showed euro zone business activity shrank much more than expected in July.

• A survey showed the downturn in euro zone business activity deepened much more than expected in July as demand in the bloc's dominant services industry declined and factory output fell.

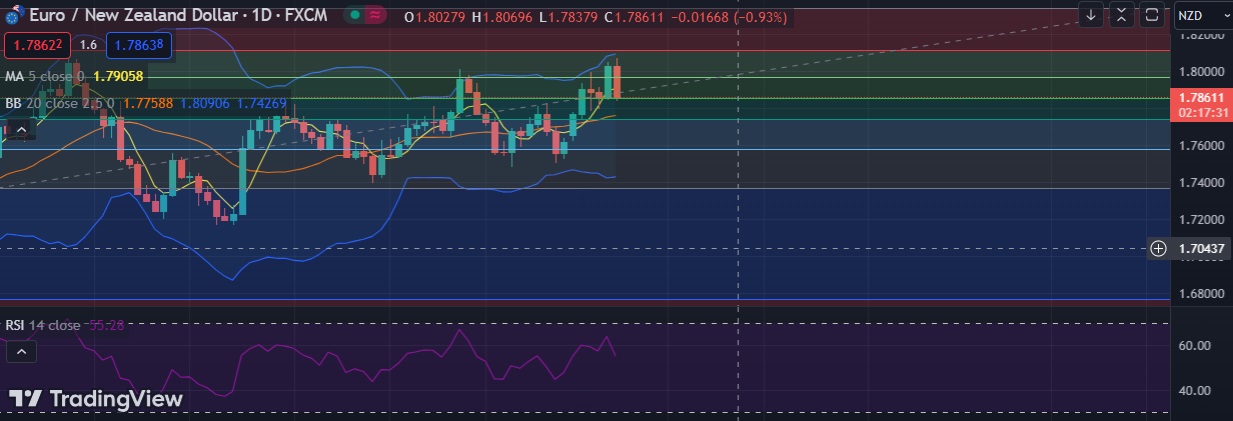

• EUR/A NZD chart has taken a turn for the worse after todays drop.Overall risk growing for a bigger drop towards 1.7750.

• Technical signals show the pair could lose more ground as RSI has turned bearish, and 9, 11,21 DMA’s are trending south.

• Immediate resistance is located at 1.7905 (5DMA), any close above will push the pair towards 1.7970(38.2%fib).

• Immediate support is seen at 1.8851 (50%fib) and break below could take the pair towards 1.7739 (61.8% fib).

Recommendation: Good to sell round 1.7860, with stop loss of 1.7950 and target price of 1.7800