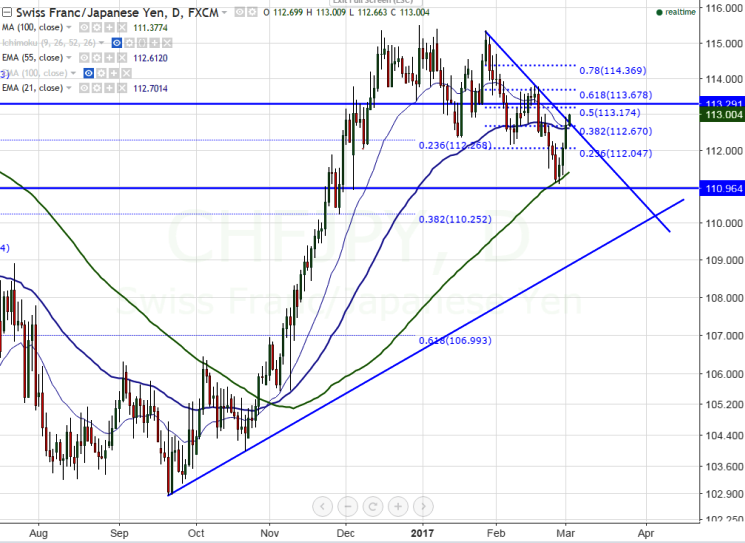

- Major support – 111 (100 –day MA)

- Major resistance -113.22 (daily Kijun-Sen)

- The pair jumped till 112.99 at the time of writing and slightly declined from that level. Short term trend is slightly bullish as long as support 111 holds.

- JPY is trading weak against all major pairs on account of increased probability of US Fed rate hike in Mar.

- On the higher side, any break above 113.22 will take the pair till 113.79 (Feb 16th high)/ 115.50 (Dec 30th 2016 high).The pair correction ends at 111.02 form the high of 115.51 and any further weakness only below 110.92.

It is good to buy on dips around 112.35-40 with SL around 111 for the TP of 115/115.50.

Resistance

R1- 113.22

R2 -113.79

R3- 115.50

Support

S1-112

S2-111

S3- 110.25