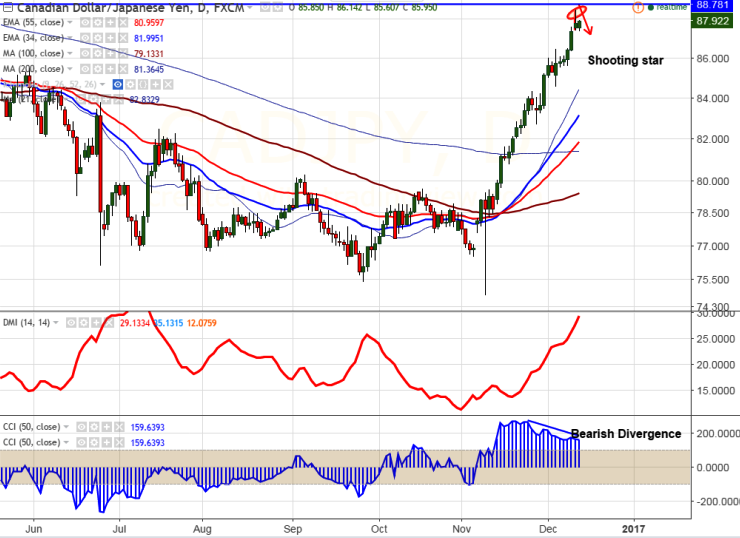

- Candlestick Pattern –Shooting Star

- Major resistance – 88.60

- Pattern formed –Bearish Divergence (CCI (50)

- CAD/JPY made a top around 88.47 yesterday and slightly declined from that level. It is currently trading around 87.89.

- The pair has shown a continuous upside for past ten trading session on account of Higher crude oil prices.

- On the lower side, minor support stands at 87.10 (23.6% retracement of 82.71 and 88.47) and any violation below will drag the 86.60 (5- day MA)/85.87 (10- day MA).Minor weakness can be seen only below 84 level.

It is good to sell on rallies around 88.10 with SL around 88.60 for the TP of 86.60/85.90

Resistance

R1-88.60

R2-89

R3- 90

Support

S1-87.10

S2-86.60

S3- 85.85