We immediately took the view that the adjustments of the Japanese monetary policy implemented by the Bank of Japan last week amounted to a capitulation on the part of the BoJ. In the meantime, reports have emerged that the BoJ considered rate hikes twice this year. That confirms our fears that the more flexible interpretation of the yield curve target was nothing else but the beginning of the end of ultra-expansionary monetary policy in Japan.

USDJPY had remained in a narrow range (2% from mid-109 to mid-111) until early this week as both USD and JPY moved together.

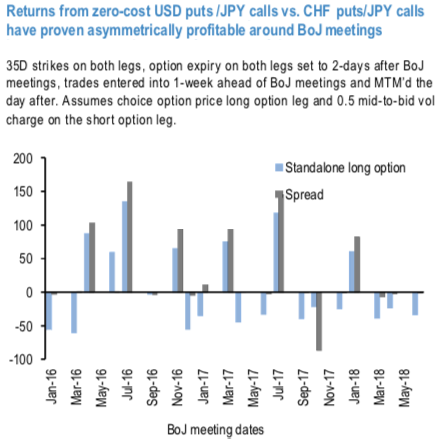

Buying long USD puts/JPY calls around the events provides with a decent performance since 2006 (refer above chart).

However, considering zero cost structures long USD puts/JPY calls vs short CHF puts/JPY calls (assuming 0.5 mid- to-bid charge on the short leg) delivers much more convincing results, with a (on average) positive and highly asymmetric stream of returns.

The long/short strategy underperformed the long only position in only two of the seven market-moving meetings, delivering a negative P&L in just one occasion.

This looks like a good opportunity for positioning for a hawkish BoJ in the months to come.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 84 levels (which is bullish), while JPY is at 111 (bullish) while articulating (at 13:10 GMT). For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes