USD/JPY saw a 50-point rally as BoJ Gov Kuroda felt the need to clarify his comments from last week.

BoJ Governor Kuroda said he was not trying to influence or predict the level of the exchange rate in his comments last week.

He also highlighted that his comments referred to the REER, not the USD/JPY rate (nominal rates of two specific nations).

Japanese trade balance is likely to print with a slight contraction at -0.17Tln from previous flash at -0.21Tln later part of the trading session today.

Currency Derivatives Strategy: USD/JPY Call ratio spread

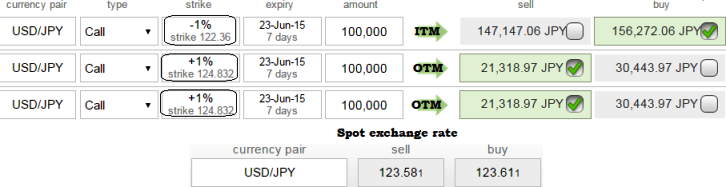

On the verge of today's significant Japan's trade balance data release, the recommendation would be "call ratio spread" as the pair is likely to remain either sideways or slightly bullish in our view.

Add 30D (-1%) In-The-Money long positions on 0.75 delta call options of USD/JPY (strike at 122.349),

Simultaneously 2 lots of 7D shorts on (+1%) Out-Of-The-Money Calls with positive theta value.

The portion should ideally be in the ratio of 1:2 but it can also be constructed with 1:3 using additional OTM call as well with not more than 10D period on short side for expiry.

Breakeven will be at: short strike price + difference in strike price + net credit

FxWirePro: Yen unmoved by Kuroda's remarks, Apply 1:2 call spread for USD/JPY

Tuesday, June 16, 2015 7:05 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate