Among G7 currency pool, Yen received a shot in the arm various global as well as domestic economic factors such as preliminary GDP numbers, Yuan's devaluation and Fed's overweighed interest rate manipulations. Global manufacturing confidence looks fragile again, led by China, Our preliminary reading of the August global manufacturing confidence points to a third consecutive slowdown in August, to -0.63 from -0.52, as China's manufacturing sector deteriorated to the worst level since March 2009 and the US manufacturing confidence declined further in August, reinforcing our view that Q3 expansion will be modest.

More GBP shorts today cannot be ruled out but for foreign traders are advised to safeguard their FX exposures through put spreads, we feel Yen's gains on cards but is it good enough to keep currency exposures in naked positions and confront sterling's uncertainty; this has certainly been a tough call.

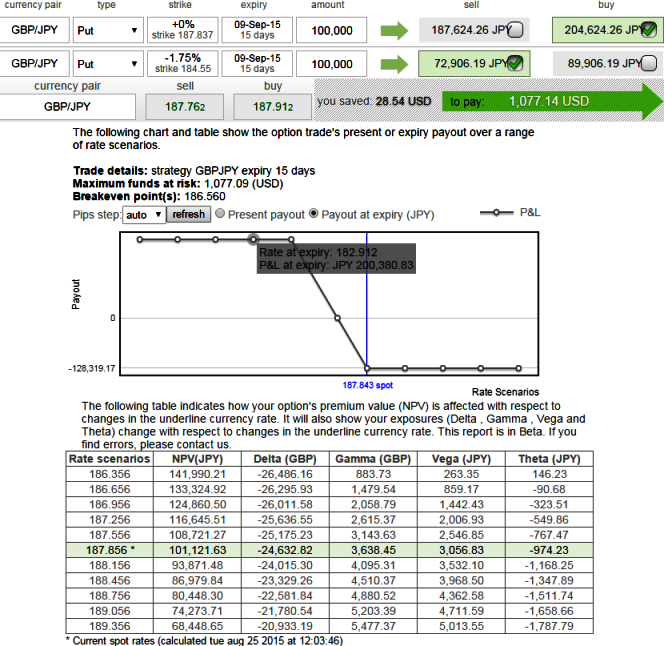

Therefore, bear put spread shall be used over Protective Put as the premiums on naked puts prove too costlier.

Bear Put Spread = Long 15D at the money -0.5 delta Put (187.725) + Sell another 7D (-1.75%) out of the money put with lower Strike Price (Out of the Money = 184.539) with net delta should be at -0.24.

For a net debit bear put spread reduces the cost of hedge by the premium collected (¥72906.94 on the shorts of OTM put) and keeps hedger to participate on upward moves but it comes at the expense of Partial hedge rather than a complete hedge.

FxWirePro: Yen on upper hand owing global macroeconomic factors - Hedge GBP/JPY with debit put spread

Tuesday, August 25, 2015 7:22 AM UTC

Editor's Picks

- Market Data

Most Popular

9