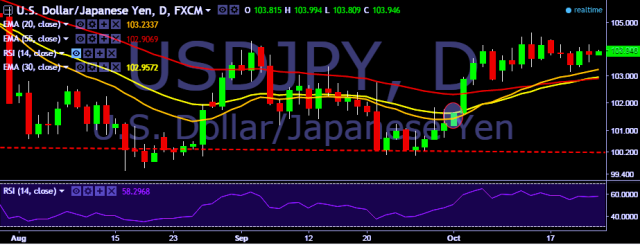

- USD/JPY is currently trading around 103.90 marks.

- It made intraday high at 103.99 and low at 103.80 levels.

- Intraday bias remains bearish till the time pair holds key resistance at 104.20 levels.

- A daily close above 104.20 will take the parity higher towards key resistances around 105.50, 106.12, 106.72, 107.49, 107.90 and 109.13 levels respectively.

- On the other side, a sustained break below 103.52 will drag the parity down towards key supports around 102.67, 101.56, 100.30, 99.27 and 98.78 levels respectively.

- Japan flash October manufacturing PMI rises to 51.7 from final 50.4 in September, fastest expansion in 9 months.

- Japan September exports y/y increases to -6.9 % (forecast -10.4 %) vs previous -9.6 %.

- Japan September imports y/y increases to -16.3 % (forecast -16.6 %) vs previous -17.3 %.

- Japan September trade balance total yen increases to 498.3 bln JPY (forecast 341.8 bln JPY) vs previous -18.7 bln JPY.

FxWirePro: Yen gains on the back of higher than expected manufacturing PMI data

Monday, October 24, 2016 1:28 AM UTC

Editor's Picks

- Market Data

Most Popular