Demand/Supply equation: On the demand side, investment grade retail funds saw an inflow of €800mm (0.6% of AUM) last week. This was a reduction from the record inflows of €1.6bn last week. While last week saw a solid €10.7bn of investment grade issuance from sixteen new deals, picking the pace up from last week. High yield continued to see a steady pace of issuance in the primary markets with €2bn from five new tranches. We expect primary markets to remain open next week, before effectively shutting for the holidays from 11th December.

Hedge against a double hit risk: Buy straddles on EUR 15y30y to be long vol with a positive vol rolldown.

Rationale: trade the core view and hedge the pain. We expect yields to de-anchor in 2018. Yet, various risk scenarios could prevent rates from taking off. The risk of an equity market correction is one of them. If coupled with lower equity prices and wider credit spreads, even a limited decrease in rates would be a pain scenario for various institutional investors, and especially so for pension funds and insurers.

The IMF highlights the vulnerability of lifers to market and credit risks. A sharp fall in risk asset prices combined with a flight to high-quality sovereign bonds would amount to a double hit on insurers and PFs balance sheets.

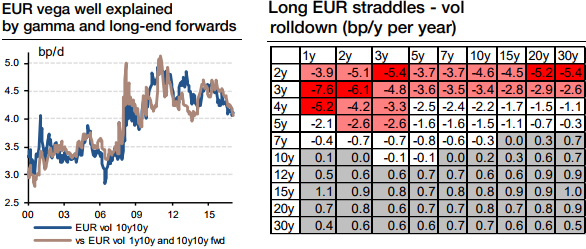

Implementations: buy EUR bottom-right vega EUR vega is typically well explained by short expiry vol and long-end forward rates (refer above table and graph). The 1y10y vol and the 10y10y forward rate account for 83% of the 10y10y vega moves since 2000. The same model is valid for 7y30y or 15y30y. Higher gamma vol drives vega up, but higher long maturity forwards drive vega down. Vega would follow gamma up in a bond sell-off, and especially so if the long-end of the curve bear-flattens. But vega would also move up in a flight-to-quality scenario bull-flattening the EUR curve – even if gamma vols do not spike significantly. So long EUR vega positions are a good hedge against such a debacle risk.

The execution: long vol strategy with positive vol rolldown Long positions in EUR bottom-right vega benefit from a positive vol rolldown (refer above graph). They are hence attractive as strategic vol longs. For instance, the vol rolldown finances roughly 15% of theta in a long 7y30y straddle position and almost 60% of theta in a long 15y30y, making the overall rolldown much less penalizing than for the 5y5y benchmark point (refer above graphs). For the 7y30y, theta cost is completely financed if the 7y30y vol increases in one year’s time by 4.5bp/y (i.e. 0.28bp/d), i.e. moves back to levels seen in 1H 2017. The corresponding breakeven move for the 15y30y vol is only 1.7 bp/y (0.11bp/d). Courtesy: SG

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays