As per last weekly reporting, European high yield funds registered an outflow of €771mm (1.3% of AUM) for the week ending 22 November.

There was a €143mm (2.1% of AUM) net outflow for ETFs and a €53mm (0.6% of AUM) net outflow for short duration funds.

Last week’s fund outflow of €806mm (1.3% of AUM) is revised to an outflow of €829mm (1.4% of AUM).

Let’s now move onto the core area, EUR longs are within 4% of their three-year highs. Meanwhile, the 10- year Treasury/Bund spread remains within a whisker of 200bp, a level it broke through a year ago for the first time since 1989.

These are the two obstacles euro bulls need to get through and even if the euro continues to unwind undervaluation with the help of strong economic data and now, optimism that a coalition government can be formed in Germany, it will inevitably be heavy going.

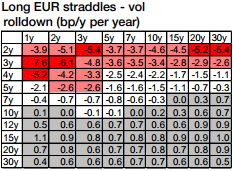

Long positions in EUR bottom-right vega benefit from a positive vol rolldown (refer above graph). They are hence attractive as strategic vol longs.

For instance, the vol rolldown finances roughly 15% of theta in a long 7y30y straddle position and almost 60% of theta in a long 15y30y, making the overall roll down much less penalizing than for the 5y5y benchmark point (refer above graphs).

For the 7y30y, theta cost is completely financed if the 7y30y vol increases in one year’s time by 4.5bp/y (i.e. 0.28bp/d), i.e. moves back to levels seen in 1H’2017. The corresponding breakeven move for the 15y30y vol is only 1.7bp/y (0.11bp/d). Courtesy: SG

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure