This is an emphasis to shed some light on low vol pairs among G10 OTC markets, implications and their trading opportunities in this space.

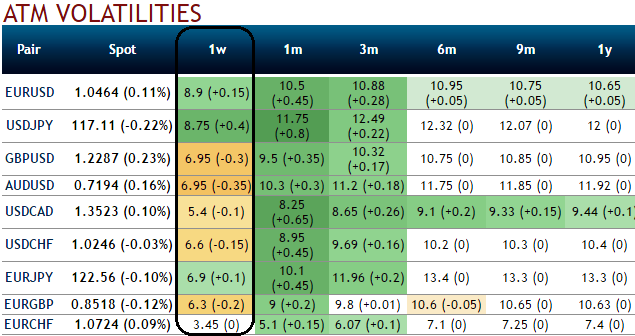

Please be noted that GBP and CHF crosses are the least IVs among G10 space, USDCHF and EURCHF vols are collapsing below 6.75% and 3.5% respectively.

Well, capitalizing on lower IVs we eye on shorting at the money calls with shorter expiries which would lock in certain yields by initial receipts of premiums and risk reversals to favor longs in puts in lengthier tenors.

While EURCHF OTC markets also predict the choppy range to prolong further as you can probably make out from the lower IVs of ATM contracts over various tenors, 3.5% and 5% for 1W and 1m expiries respectively (the least among G20 currency space).While 25-delta risk of reversals of EURCHF have been neutral with the no significant hedging sentiments.

GBPUSD has also been in the tight range of 1.23 and 1.2253 levels but slightly weaker going forward but in near run don’t expect dramatic spikes nor even deep slumps. Hence, below are the option trade recommendations so as to match the lower IV times.

Naked Strangle Shorting for EURCHF:

At spot ref: 1.0744 with range bounded trend keeping in consideration we would like to remain in the safe zone by achieving certain returns though shorting a strangle.

Overview: Slightly bearish in short term but sideways in the medium term.

Time frame: 7 to 10 days

The execution: Short 1W OTM put (1.5% strike difference referring lower cap) and short OTM call simultaneously of the same expiry (1% strike referring upper cap) (we reiterate, preferably short term for maturity is desired).

Moreover, the strategy could be counterproductive as the skews in 1w IVs favors OTM puts strikes.

Iron condors for GBPUSD:

Background: - Although cable bulls have attempted to bounce in recent times, short-term volatility is likely to benefit the USD on diverging monetary policy indicate a stronger USD, the prevailing spot rates are not far away from all-time lows (spot ref: 1.2268). Fed has raised its hiking bias from 2 to 3 more hikes in 2017 that could hinder upside potential of this underlying pair.

Well, using options expiring on the same expiration month, the option trader creates an iron condor by selling 1w (0.5%) OTM put and buying an even lower strike (1%) OTM put of the same expiry, similarly shorting 1w (0.5%) OTM call and buying another even higher strike (1%) OTM call of the similar tenor. The position results in a net credit to put on the trade.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady