We’ve already highlighted in our recent write ups on richness in EURJPY skews.

For more reading on EURJPY IV skews, please follow below web links:

http://w1.biz.fxwire.pro/news/preview?id=530056

http://w1.biz.fxwire.pro/news/preview?id=530196

At the other end of the spectrum, one cross-yen vol that does not feature in our buy list is EURJPY. This is in part because there is little daylight between ECB and BoJ policy stances to engineer a meaningful trend in the cross, and partly because of the comparable trade conflict betas of EUR and JPY, both of which serve as alternative reserve currencies and therefore liable to co-move directionally during stress.

Despite this, EURJPY 3M3M forward vols are outlier rich on our screens (refer above chart) due to the heavy day-weight effect of European elections in Q2, in effect discounting extreme European political stress wrought by populist electoral uprisings.

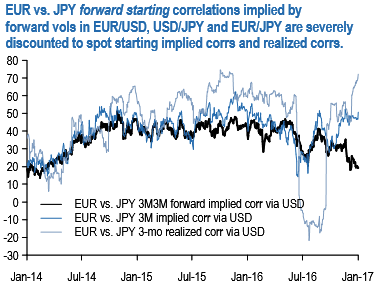

We consider such an outcome low odds but are not brave enough in a year of many unknowns to sell EURJPY forward vol outright. It is interesting however that the degree of this forward vol richness is outsized even adjusting for 3M3M forward vols in EUR/USD and USD/JPY legs, as evidenced by extremely depressed EUR vs. JPY forward starting implied correlations.

The next chart illustrates that the extent of the dislocation: BS 3M3M forward starting implied corr. is currently near 3-year lows around 20%, while spot starting BS implied corrs and realized corrs are an eye-watering 3050 % pts. higher.

This in our view is an enormous carry buffer that more than compensates for European election risks that in our view aren’t all that catastrophic in the first place; sellers of EUR/JPY forward vols (FVAs) can therefore do so more ‘safely’ and collect hedged vol carry in the process by buying weighted amounts of EUR/USD and USD/JPY FVAs against their shorts (in 100: 80:-150 vega ratios on EUR, JPY and EUR/JPY legs respectively to replicate a forward starting correlation swap).

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch