Bearish GBPAUD scenarios below 1.76 areas given:

1) The BoE passes on a May hike;

2) Core UK CPI continues to moderate and wages remain sticky below 3%;

3) The UK and EU fail to agree on the Irish border, leading to a non-negotiated Brexit);

4) Overt UK balance of payments pressure

5) China easing policy and commodities rebound would be a cushion for the Aussie dollar.

Bullish GBPAUD scenarios above 1.8520 levels given:

1) The UK Parliamentary majority in favor of customs union membership frustrates a hard Brexit;

2) Rejection of the withdrawal bill in parliament precipitates fresh election and/or 2nd referendum.

3) The Aussie unemployment rate moves back towards 5.75%, raising risks that the RBA responds to a weakening labor market.

4) China data weaken materially, and risk markets retrace and vol rises.

Potential trigger events: Brexit talks and EU Summit Jun 28-29, BoE (May 10).

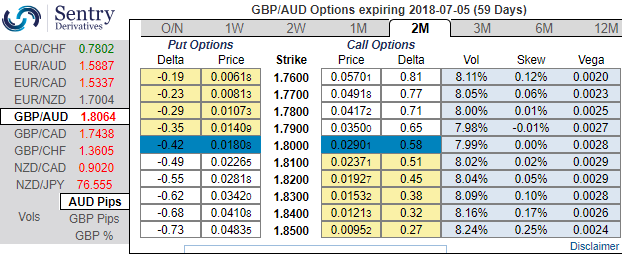

OTC updates:

Please be noted that the positively skewed IVs of GBPAUD oof 2m tenors is well-balanced on either side.

Well, all the above-stated macros standpoints are factored in OTC setups that could propel GBPAUD either side but with more downside potential. Accordingly, we advocate below hedging strategy with the cost-effectiveness that could hedge regardless of the swings on either side.

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

The execution: Initiate long in GBPAUD 2M at the money -0.49 delta put, long 2M at the money +0.51 delta call and simultaneously, short theta in 2w (1%) out of the money call with positive theta or closer to zero. Theta is positive; time decay is bad for a buyer, but good for an option writer.

The Vega of a short (sell) option position is negative and an increasing IV is bad. We encourage vega longs and short thetas in the non-directional trending pair but slightly favors bearish strategy as the vega signifies the sensitivity of an option’s value owing to a shift in volatility.

Currency Strength Index: FxWirePro's hourly GBP spot index has turned into 34 (which is mildly bullish), while hourly AUD spot index was at shy above -42 (mildly bearish) while articulating (at 13:15 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?