There are no changes this month to our moderately constructive EUR forecast following yet another turgid month in which EUR crosses have continued to respect the pitiful three cent range that has endured for over three months now.

That being said, we’ve shown scenarios of EURJPY price trends contemplating the macro-economic data-flow that has been almost uniformly poor over the past month and we may need to temper our targets for the euro and/or flatten the trajectory if the economy fails to find a footing and rebound relatively quickly.

Bullish EURJPY scenarios (see 140 by the Q2 end) if:

1) The growth rebounds to 3% by mid-2018;

2) ECB becomes more comfortable with progress on wages and core inflation.

Bearish EURJPY scenarios (see 128 by the Q2 end) if:

1) The Growth fails to rebound above 2%

2) EUR appreciation and/or sluggish core CPI delays ECB policy normalization

3) The BoJ does not move even if core inflation rate rises more than expected.

Most importantly, please be noted that the positively skewed IVs of 3m tenors are signifying the hedging interests in the bearish risks. The bids for OTM put of these tenors signal that the underlying spot FX likely to break below 129 levels so that OTM instruments would expire in-the-money.

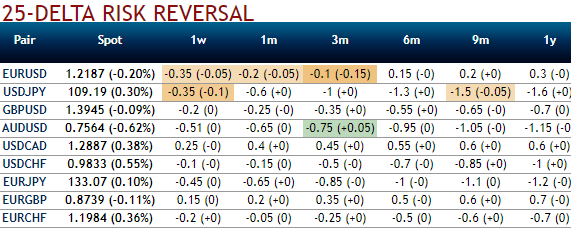

While bearish neutral risk reversal numbers are also substantiating that amid minor upswings, the downside risks remain intact in long run.

Options strategies for hedging:

Contemplating above fundamental driving forces and OTC indications, we’ve devised various options strategies:

Buy 2M EUR puts/JPY calls vs. sell 2M 28D EUR puts/KRW calls for directional traders.

Buy 2m EURJPY ATM -0.49 delta puts for aggressive bears on hedging grounds. If expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1.

Sell 4M EURJPY 25D risk-reversal (buy EUR calls - sell EUR puts), delta-hedged for risk-averse traders.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -16 levels (which is neutral), while hourly JPY spot index was at -37 (bearish) while articulating at 08:06 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data