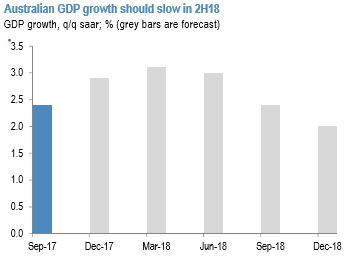

In 2018, the main bearish risk to AUD (aside from China-related weakness) comes from a lift in market volatility. We expect both monetary policy divergence and modestly weaker commodity prices to push the currency lower. We are also expecting the pace of domestic growth momentum to decline in 2H18, after a boost from net exports in the first half of the year (refer 1st chart).

NZD was not immune from the broad forecast upgrades we pushed through earlier in the month. Domestic growth has weakened, the RBNZ’s inflation forecasts have been revised materially lower, net immigration is slowing and business confidence has plunged since the change of government (refer 2nd chart).

Over 2018, we still see scope for under-performance from NZD, though this is now more contingent on ongoing confirmation that the RBNZ can credibly lag policy normalization in the G3+, and perhaps on evidence that real assets (equities, housing) are threatened by late-cycle growth dynamics and government intervention.

AUDNZD in a neutral state near term, a 1.0700-1.0800 range likely to contain.

Medium-term perspectives: During the next month there’s potential for a further decline below 1.07, given recent interest rate and commodity movements have slightly favored the NZD.

Trade DNT’s: Contemplating both short term and long term technical of AUDNZD, we recommended certain yields but a limited loss structure via double-no-touch optionality in next 1-month, AUDNZD 1m DNT with 1.05/1.0950 strikes (maintained 50 pips as a tolerance on either side) – we are reluctant to sell volatility outright given the unquantifiable risk. However, shorting volatility and fading the spike in skew through limited loss structures (i.e. DNT’s) could be appropriate.

Alternatively, deploy short hedge using futures contracts of mid-month tenors with a view to arresting bearish risks below 1.07 levels.

These are the conviction trade and it is wise to jack up speculative leveraged positions in order to fetch exponential yields than the spot moves.

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing at -57 levels (which is bearish), while hourly NZD spot index was at shy above 3 (neutral) while articulating (at 06:42 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data