Brexit, US-Sino trade war, global recession risk factors on GBP: it would be easy to supplement the list of global risk factors. Subjectively, many people feel that we are living in remarkably uncertain times.

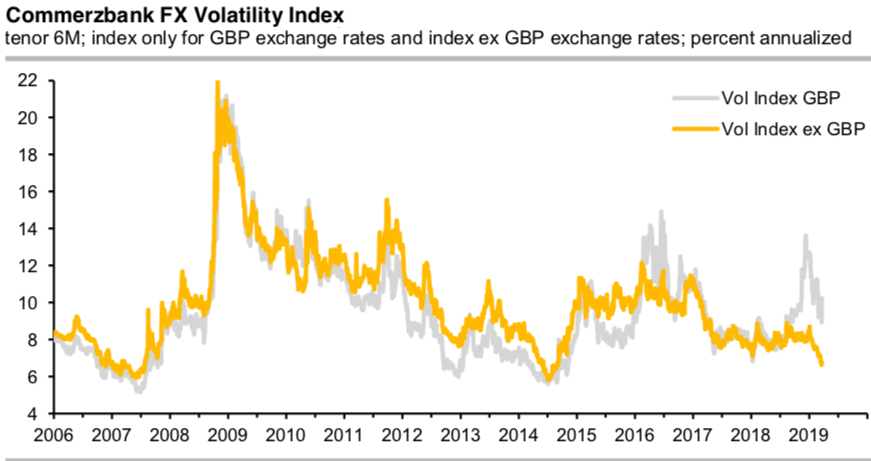

However, implied FX volatilities – usually regarded as the market’s projection of the intensity of future FX moves – recently fell to extremely low levels. Sure, there are exceptions. GBP implied volatilities continued to trade at elevated levels due to Brexit risk. But even they fell recently and could not resist the apparently relaxed mood of the FX options market. Stripping GBP volatilities from Commerzbank FX Volatility Index reveals the exceptionality of the current situation.

Commerzbank FX volatility index aggregates exchange rate volatilities of the 35 most intensively traded currency pairs of the latest BIS Triennial report (currently: 2016), weighted by their trading volume (refer above chart). The Index can be calculated for different tenors. Subjectively, the 6M tenor is to be a good reflection of the general FX vol picture.

We can calculate sub-indices, e.g. by stripping out all GBP exchange rates (currently with a weight of 12.1%) to get an FX Volatility Index ex GBP. We can also concentrate on volatilities of GBP exchange rates only, by aggregating only GBPUSD and EURGBP volatilities.

The Volatility Index (ex GBP) has fallen to values comparable to summer 2014 and spring 2007 – the extremes in our index history.

From the experience of 2007 and 2014, we can learn, however, that these episodes cannot last forever. The lower implied vols are trading, the more vulnerable is the market to jumps in exchange rates, which can hardly be compensated even be the cleverest delta-hedging strategies. Why? Low implied volatility means that delta-hedging of options positions requires higher adjustment frequencies.

In market equilibrium, the fundamentally required exchange rate moves, therefore, have to happen at finer and finer time scales, otherwise, they are dampened by contrarian delta hedgers. To make them happen, in the end, only sudden jumps can occur. No wonder that we observed such a hefty move in USD exchange rates after the Fed decision on Wednesday. And no wonder we are currently seeing such a hefty risk-off move, partly amplified by disappointing Eurozone PMI data, but that was certainly not the underlying cause (as TRY weakness, e.g., started significantly earlier).

Jump in GBP risk reversals (a move that was certainly overdue, given the Brexit risks) served as a trigger starting an erosion of the low-vol environment. The hefty jumps in many spot FX rates might be the final blow to this market situation.

Political stability is relevant for a reserve currency but if the experience of GBP is anything to go by this quality may be rather over-rated and the dollar rather less vulnerable than is commonly supposed to the influence of an iconoclastic president, even one who could yet serve two terms.

The simple fact is that GBP hasn’t come close to squandering its second-tier reserve currency status despite the complete nervous breakdown in the UK political system over Brexit.

Indeed, central banks have added almost $70bn of GBP reserves on an underlying basis since the fateful referendum in 2016 (approximately a 17% increase). The lesson is that reserve currency status may be rather more difficult to lose than a country’s reputation for political propriety and competence. Courtesy: JPM & Commerzbank

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing at -41 levels (which is bearish), while EUR is at 18 (mildly bearish), hourly USD spot index was at 107 (highly bullish) while articulating at (13:23 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand