We expect the ECB to announce an extension of its bonds purchasing program beyond March 2017 at its last meeting of the year. This step is likely to become even more urgent if it has to stop a further rise of yields on Italian government bonds.

On the other hand, the pressure for further expansionary measures on the part of the ECB has eased since the US Presidential elections. USD appreciation that led to euro weakness should not only support foreign demand for export goods but also fuel inflation.

This is mainly due to the fact that the number of bonds the ECB is allowed to hold from one issuer is limited to one-third of those outstanding. The ECB will only be able to extend the QE program if it changes its technical parameters and even then the risk of running out of bonds will force it to reduce the bond purchasing volume by the end of 2017, which is likely to support the euro.

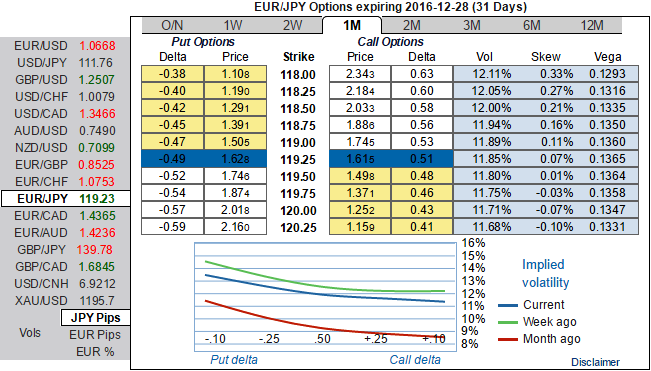

OTC updates:

Yen IVs against euro: Please be noted that the 1m IV skews are more biased towards OTM put strikes, significant changes can indicate a change in market expectations for the future direction in the underlying forex spot rate and these risk reversals evidences the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market.

Even less event-sensitive longer-dated vol sold off hard (3M -1.25, 1Y -2.8), possibly indicating the market’s long vol pre-positioning going into the event that the (non) event proved to be unjustified.

Why would there be a difference in the implied volatility levels of at-the-money options and put options with strikes below the current spot price?

These implied volatilities level associated with an option does not only reflect the expected level of actual volatility in the underlying spot FX (or else it would indeed by the same for all options on the same underlying expiring on the same day).

Rather, the implied volatility level also reflects the supply and demand for options who only vary in terms of their strike.

Here, in this case, the positively put skews and puts are trading at 30% implied volatility levels compared to at-the-money options which are trading at say 20%, then this is because the demand for these puts is higher.

Why might the demand be higher? Well, in the case of put options on say underlying spot FX, a positive put skew might reflect demand from investors looking to hedge their downside risk. There can be a natural bias in the market to prefer downside protection to upside protection (because investors tend to be naturally long the underlying market).

So an ‘options put skew’ refers to the level of implied volatility for options whose strike is below the at-the-money price relative to the implied volatility of at-the-money options.

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?