EUR-cross-risk-reversals have understandably re-priced sharply in the direction of EUR calls, especially against G10 commodity currencies that were among the worst performers on the week.

We struggle to see severe dislocations in this space at current levels, with some mild value only in EURCAD 3M riskies at 0.4 which we are not inclined to chase in light of the cheapness of the loonie on short-term models and the potential for an oil rebound in coming weeks that can cap the extent of EURCAD strength. EURCNH riskies (3M 25D -0.05) however strike us as interesting buys.

First, EURRMB has a long history of high correlation to EURUSD which has been formalized since late 2015 by virtue of China’s migration to basket FX mechanism that assigns a significant (16.3%) weight to the common currency; hence EURCNH is a bonafide proxy for expressing a core bullish Euro view.

Second, it offers exposure to CNY disorder without charging a vol premium, making it an excellent hedge against USDCNH carry trades that have been instituted lately in anticipation of an oriental summer snooze fest.

Delta-hedged EURCNH risk-reversals also offer substantial positive carry (options are net costless, the short EURCNH forward delta-hedge is carry positive; refer above chart), hence qualify as standalone bleed friendly risk hedges in vol portfolios.

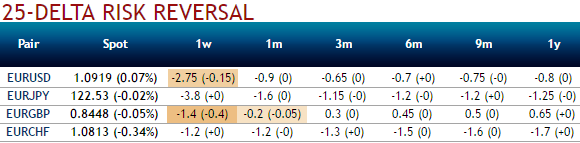

Please be noted that the above nutshell evidencing delta risk reversal numbers of major euro crosses are flashing up higher negative prints to indicate the mounting hedging interests for bearish risks. 25-delta negative risk reversals would imply that the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market and also implies puts have been in more demand than calls, consequently, the downside protection is relatively more expensive.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure