There are three factors we would cite as having helped EUR cope with the region’s limp economy thus far:

1) The currency is structurally undervalued, meaning there is already a decent risk premium for the chronic underperformance of the economy. The EUR REER is 5% below its 20Y average whereas USD is 5% expensive.

2) Despite the economic slowdown in 2018 the ECB still terminated QE last year and for good measure was prepared until only very recently to begin to normalize interest rate policy.

Consequently, there has been little real pass-through from a weaker economy to monetary policy and hence to the exchange rate.

3) The Euro area may have mediocre growth but it has the strongest underlying balance of payments position in G3.

Last year this BoP support was supplemented by relative aggressive central bank flows from USD into EUR. We estimate that central bank reserve diversification added 1.25% of EUR demand to the 3.3% of GDP accounted for by the region’s basic balance surplus (the current account together with net equity and FDI flows). This structural demand for EUR set quite a high bar for the currency to depreciate.

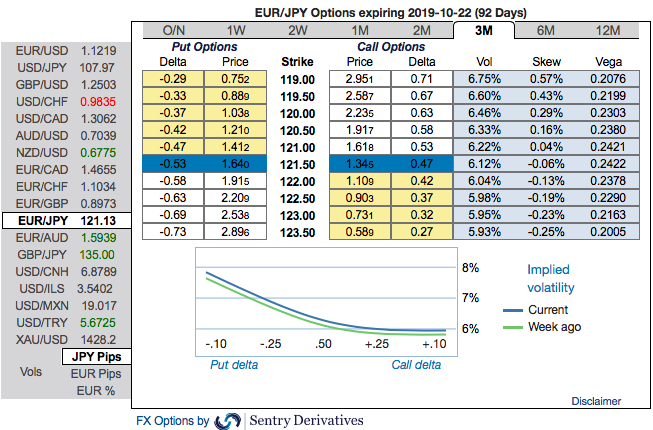

EURJPY trend has been weaker in both minor and major trends amid some abrupt rallies. The European Central Bank (ECB) is scheduled for the monetary policy on July 25th. ECB’s readiness to cut its key rate next week is foreseen. And there is no reason for the euro to appreciate considerably in the short run. Let’s now quickly glance through OTC outlook:

Please be noted that the positively skewed IVs of 3m tenors that are also signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors expect that the underlying spot FX likely to break below 119.00 levels so that OTM instruments would expire in-the-money.

Most importantly, to substantiate the above indications, we could see some minor positive shifts in existing bearish risk reversal set-up of EURJPY that indicates the long-term hedging sentiments across all tenors are still substantiating bearish risks amid minor abrupt upswings in the short-term. Please be noted that 3m IVs are overall OTC barometer is a noteworthy size in the forex options market that can stimulate the underlying forex spot rate.

We’ve advocated buying 3m EURJPY (1%) ITM -0.79 delta puts for aggressive bears on hedging grounds as the mild abrupt upswings were contemplated earlier.

Alternatively, ahead of ECB monetary policy meeting, we advocated shorts in futures contracts of mid-month tenors with a view to arresting potential dips. We now wish to roll over these contracts for August month deliveries. Source: Sentrix and Saxobank

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks