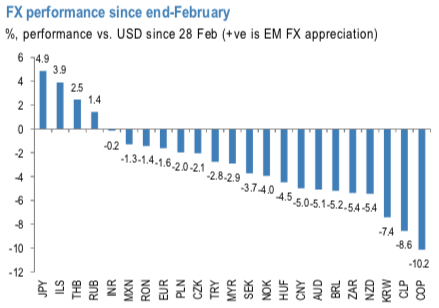

The underperformance of South African local markets the past several months has been remarkable. Despite the dovish shift of the Fed and the SARB interest rate cut, since the start of March (prior to the beginning of the current phase of the global bond rally), the currency has lagged the performance of high yielding peers including Brazil, Mexico, Russia, and India (refer 1st chart).

A narrative shift is underway and mixes uncomfortably with stretched SAGB positions. It is not difficult to explain the recent poor performance of South African local markets given the market’s focus on fiscal woes. The fact remains, however, that South Africa is not the only emerging market with difficulties; one could argue that the rand’s role as a liquid “EM proxy” could have resulted in greater outperformance in the period of positive EM local market returns prior to the re-escalation of the US-China trade war this week. What gives? We suspect that a broader ‘narrative shift’ is underway; one which alters the risk characteristics of local assets and the lens through which investors view South Africa in a profound way.

The risk-reward of ZAR has already changed. One way to illustrate our argument that the shift of investment narrative is altering the risk-reward characteristics of the rand is to compare the currency’s performance in periods of EMFX strength and weakness (refer 2nd chart). While ZAR's 'high beta' nature has been symmetric over the long-run (1.44 beta whether the market is up or down), more recently, ZAR has tended to sell-off almost twice as much on days of broad EMFX weakness as compared to days of EMFX strength.

In other words, ZAR returns about as much as the broad EMFX index on days of EMFX appreciation (beta of 1.09 YTD), but loses twice as much as the index on days of EMFX depreciation (beta of 1.90 YTD).

Against this backdrop, we hold on to our structural bearish positions. We also recommended a 3m 14.75 USDZAR call at the end of July 23rd. The sell-off has been fast, with ZAR around 8% weaker vs. the USD since JP Morgan’s options trade monitor.

Normally, we would expect the momentum of the sell-off to abate after such a move and we will watch the market closely for signs of positioning becoming stretched. However, the starting point appears to have been a long ZAR speculative position, in our assessment. Courtesy: JPM

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action