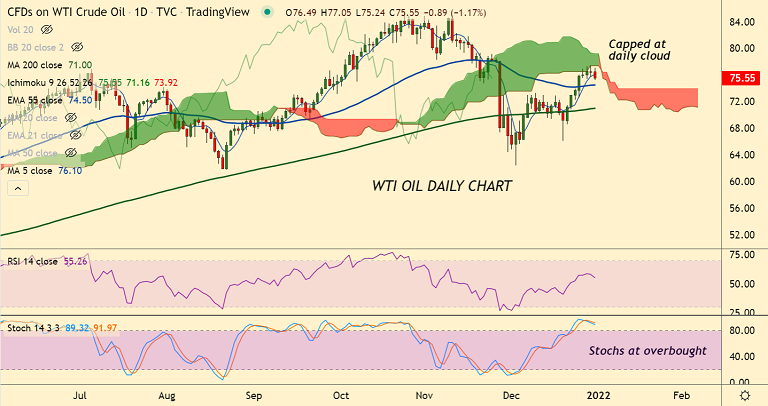

Chart - Courtesy Trading View

Spot Analysis:

WTI slips 0.75% amid choppy year-end trade, finds stiff resistance at daily cloud

Previous Week's High/ Low: 73.93/ 66.15

Previous Session's High/ Low: 77.41/ 75.80

Fundamental Overview:

As the highly transmissible variant is causing COVID-19 case numbers to surge across the world, traders await the next OPEC+ meeting on January 4th for further direction.

OPEC+ will meet to decide whether to go ahead with a 400,000 barrels per day (bpd) production increase in February.

Technical Analysis:

- WTI upside remains capped at daily cloud

- The pair has formed back-to-back Doji and spinning top formation at highs

- Price action remains capped at daily cloud

- Oscillators are at overbought levels, scope for some pullback

Major Support and Resistance Levels:

Support - 74.50 (55-EMA), Resistance - 77.40 (Cloud base)

Summary: WTI on track for massive annual gains, set to close over 56% higher for the year. Pullback on account of overbought conditions is likely to be shallow. Major trend is bullish and trend reversal only below 200-DMA.