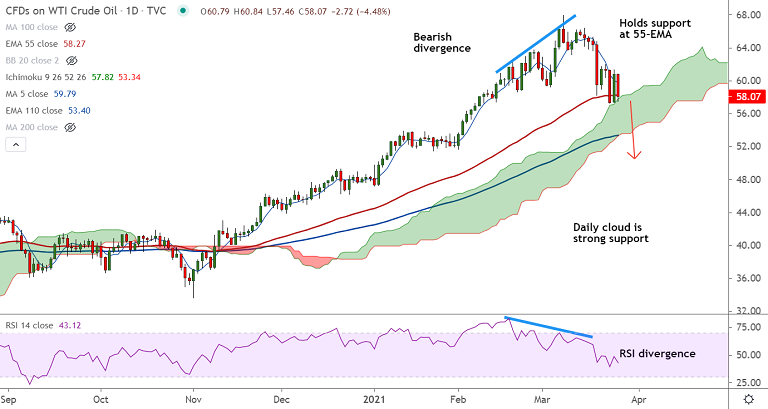

USOIL chart - Trading View

West Texas Intermediary (WTI) prices have dropped lower on the erasing most of previous session's gains.

WTI crude oil price rally on the back of the Suez Canal blockage news appears to be fading amid ongoing demand concerns.

Oil prices are extending choppy trade around 55-EMA support, scope for further weakness.

Daily cloud seems to be offering reasonable support for the time being, breach below will see further weakness.

Volatility is likely to continue ahead of next week’s OPEC+ meeting (Thursday, April 1st). Analysts expect that another hike in output at this point is unlikely.

Technical bias is bearish. Breach below cloud will fuel further downside. Next major bear target lies at 110-EMA at 53.40.