On the verge of US crude inventory level checks, WTI crude futures (CL1!) today has continued yesterday's dips from $46.24 to the current $46.03 levels, down about 0.45% ahead of today's US inventory checks, while analysts have forecasted another rise to record levels for US crude accumulation in storage.

The EIA's crude oil inventory check is scheduled to be announced on 14:30GMT, that weighs the change in the number of barrels of commercial crude oil held by US firms on a weekly basis. The level of inventories will have the impact on the price of petroleum products; Energy Information Administration is expected to publish its report tomorrow at around 1430 GMT. Analysts have forecasted it to be at 0.921M barrels. After markets closed Tuesday, the American Petroleum Institute said that U.S. oil inventories increased by 942,000 barrels in the week ended August 26.

Technically, the recent rallies have tested resistance at 49.06 levels and been rejecting prices ever since then, "Shooting star" has appeared at peaks of 47.28 to signal some weakness as leading oscillators converge prevailing price dips, overall we see more selling pressures in this commodity at the current stage.

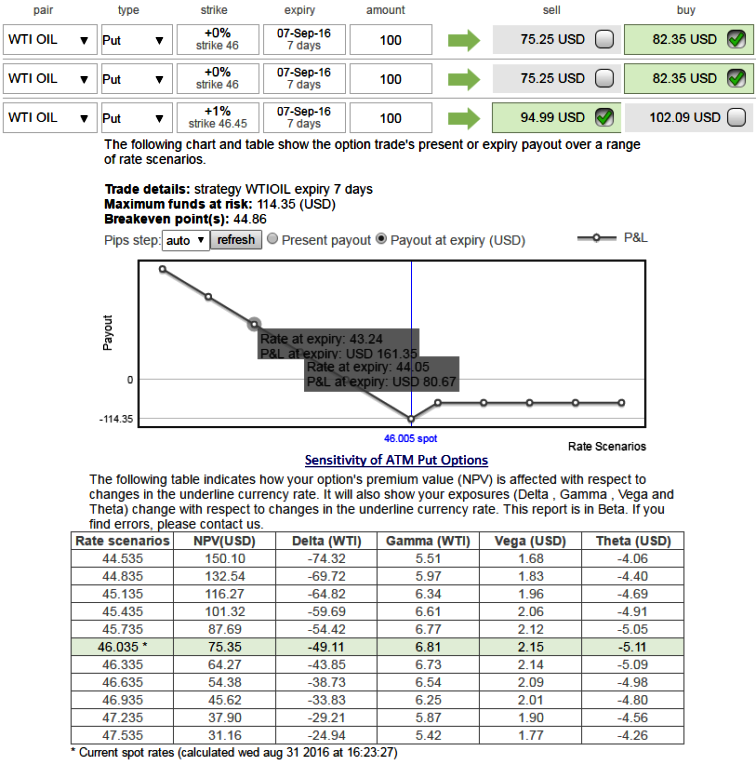

Contemplating prevailing downtrend of WTI crude, construct option strategy as shown below,

We can see the gamma differences of the ATM puts of WTI at the various forward spot across OTM and ITM regions, for a dip in the underlying price of the commodity which means the rate of change of the Delta with respect to the movement of the rate in the underlying market. But it is even better if the dips occur after 4 days as we have a short position in the strategy.

At spot WTI oil reference: $46.06, the hedger who is bearish on this commodity executes 2:1 put back-spread by initiating following trades.

Let’s just suppose hypothetical scenarios contemplating prevailing major downtrend of WTI crude. Calling for 44.75 or below levels, and shorting a 4D (1%) in the money put and go long in 2 lots of the same 1W at the money gamma puts. Thereby, the net debit would be reduced to enter the strategy and any potential downswings would be taken care by 2 lots of puts.

In the Sensitivity table, Gamma shows how much the Delta will change if the underlying rate moves by 1%. A smaller Gamma means the Delta is less likely to change as the underlying market moves.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed