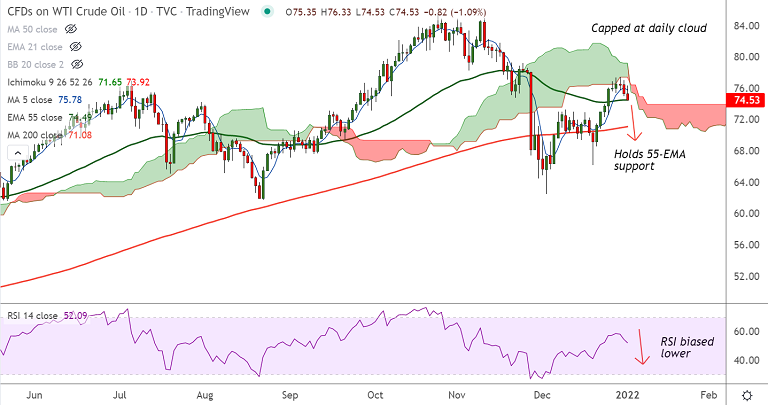

Chart - Courtesy Trading View

West Texas Intermediate crude oil prices slipped lower for the second straight session, surging Omicron cases weigh.

WTI dropped under $75.00 and was trading at $74.65 at around 14:00 GMT, down from session highs at $76.33.

Traders now focus on OPEC+ which will have a meeting on Tuesday, January 4, to decide on the oil supply strategy.

According to reports, OPEC+ cartel is expected to stick to its 40K barrel per day output hike plans when they meet this week.

Technical analysis shows some weakness for the pair. Upside is capped at daily cloud. After back-to-back Doji formation at highs, price action is extending weakness.

Price has slipped below 5-DMA and is currently holding support at 55-EMA. Break below will see test of 21-EMA.