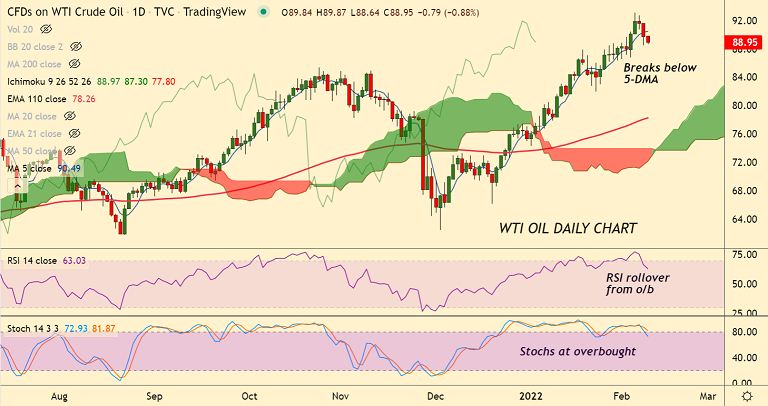

Chart - Courtesy Trading View

US oil prices extend slide for the third consecutive session, trades 0.72% lower at $89.08 per barrel at around 08:25 GMT.

WTI closed 2.03% lower on Tuesday as Washington resumed indirect talks with Iran to revive a nuclear deal.

The deal if revived could lift U.S. sanctions on Iranian oil which could quickly contribute to adding supplies to the market.

On the other side, industry data showed an unexpected drop in U.S. crude and fuel stocks, offsetting concerns of a possible rise in supplies from Iran.

Crude inventories fell 2 million barrels, according to API, missing analysts' expectations for a 4 million barrel increase.

Oil prices showed a brief uptick, but could not capitalise on the gains. WTI oil closed 2.03% lower at $89.75, paring some losses from session lows at $88.53.

Focus now on the U.S. EIA inventories data which will be available at 10:30 a.m. EST (1530 GMT).

Technical indicators suggest some weakness in the pair. Scope for test of 21-EMA support at 86.53.