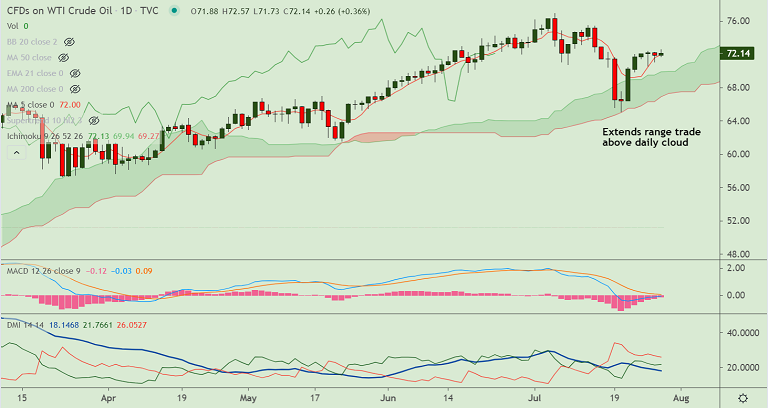

USOIL chart - Trading View

West Texas Intermediate (WTI) was extending range trade for the 4th straight session.

Pre-Fed market caution keeps traders on the sidelines, price hovers around the $72 mark.

Data released on Tuesday by the American Petroleum Institute (API) showed a bigger-then-expected draw in the US crude stockpiles.

The API report showed that the US crude stocks fell by 4.7 million barrels for the week ended July 23 vs. expectations of a drop of 2.9 million barrels.

Continuing spread of delta variant of coronavirus and the International Monetary Fund’s (IMF) cutting its growth estimates for Emerging Asia raise concerns over the demand prospects for oil.

Technical bias is neutral. 21-EMA is immediate support at 71.73, while, upside remains capped at 20-DMA at 72.73.

Focus now on the Energy Information Administration (EIA) weekly US crude supplies report and the FOMC decision for fresh impetus.