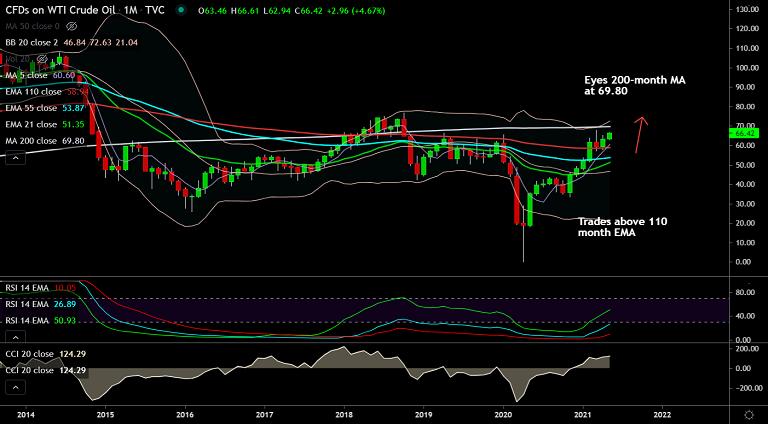

USOIL chart - Trading View

West Texas Intermediate (WTI) extends previous session's gains, hits 8-week highs above $66 mark.

The American Petroleum Institute (API), Weekly Crude Oil Stock report showed that the US inventories fell by 7.7miilions barrels in the week ended April 30th.

The fall in crude oil inventories signals strengthening demand prospects. Meanwhile, OPEC and its members are expecting a revival in consumption in H2 2021.

Economic data suggests US, Eurozone, and UK are witnessing a turnaround in their economic activity.

However, rising corona cases in Asia-pacific, especially in India, which is the third, largest consumer of energy, and Japan could limit upside.

Technical bias for the pair is bullish. GMMA indicator shows major and minor trend are bullish. Pullback has held support at daily cloud.

Oscillators are bullishly aligned, volatility is rising. MACD and ADX also support gains. Price is extending gains above 110-month EMA and is on track to test 200-month MA at 69.79.

On the flip side, 5-DMA is immediate support at 65.06. Break below will see dip till 21-EMA. Bullish invalidation only below daily cloud.