The disappointment continues from OPEC member states to reach any consensus initially.

The fact that members were unable to set any production limit means that a continued high level of production is likely, which will leave the market oversupplied.

The US EIA's short-term energy outlook confirmed that oil production seems robust at the current edge, (growing production in the Gulf of Mexico factors in), and therefore raised its production estimate for the current year again slightly.

Brent costed less than $40 per barrel again yesterday for the first time since February 2009 but recovered up to 40.46, WTI has been lingering with bearish favorite figure at 37.5 ahead of inventory data.

Hedging Frameworks:

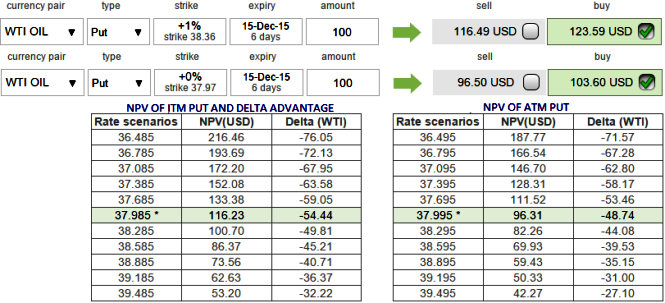

On hedging grounds, aggressive bulls can initiate long positions in naked puts but avoiding at the money puts would derive smarter approach.

But use of in the money -0.51 delta puts are advisable expecting deeper tunnel around 35 levels.

Rare opportunity:

The premiums of ATM contracts are priced in more than 7.56% of NPV while delta is just -0.48.

The premiums of (1%) ITM contracts are priced in more than 6.34% of NPV while delta is -0.54.

Thus, we reckon ITM options are in the competitive advantage of pricing as well as underlying effects on options.

This difference in delta is conducive to monitor downward directional risk which is intensifying amid crude supply glut, so you may know how much your option's value will increase or diminish as the underlying movement in crude oil market.

FxWirePro: WTI crude may head towards deep tunnel - Aggressive bears can stay hedged with ITM delta puts

Wednesday, December 9, 2015 2:59 PM UTC

Editor's Picks

- Market Data

Most Popular