The crude oil turned lower Thursday on profit-taking after bouncing off four-month lows.

The highlight of this week's report was the bullish and unexpectedly large draw in gasoline.

The U.S. Energy Information Administration said in its weekly report that gasoline inventories decreased by 3.3 million barrels in the week ended July 29, much more than the expected 0.2-million-barrel decline and report also highlights total crude inventories jumped by 1.4 million barrels.

The market chose to ignore the bearish, counter-seasonal, and surprising build in crude oil. Distillate also saw a bearish and unexpected build.

The market also chose to ignore a bearish set of product demand numbers. Total US 4w av. product demand grew by a tepid 125 kb/d y-o-y to 20.46 Mb/d (+0.6%). However, this level of growth is much less than recent downward revisions.

Last Friday, the EIA's final monthly demand figures for May were revised down by an eye-catching 1.1 Mb/d compared to the preliminary weeklies. This followed an earlier 0.8 Mb/d downward revision for April. Questions continue to be raised about US product demand.

Crude oil for September delivery on the NYME dipped 7 cents, or 0.14%, to trade at $40.78 a barrel by 07:52GMT.

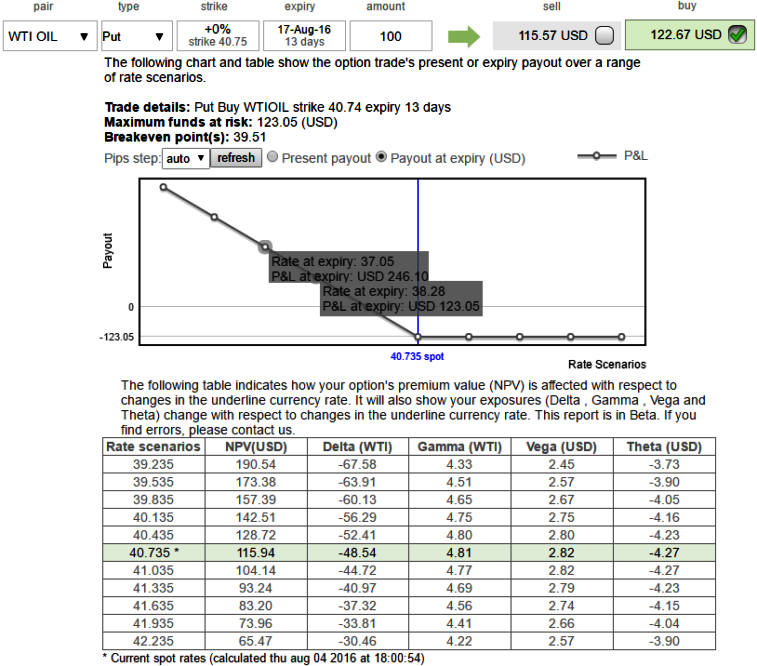

Hence, medium to long term crude oil traders who wish to invest in this commodity are advised to seek cautiously a better entry points (wait for dips) and affix an at the money -0.49 delta put option of equivalent quantities of outrights in underlying commodity, keep an expiry as long as they wish to take physical deliveries.

This strategy is usually to be employed when commodity trader is bullish on crude at this juncture, but slightly suspicious of uncertainties in the near term.

By adding this extra option position safeguards underlying portfolio but loses would be minimal and maximum to the extent of premiums paid to buy ATM options. Maximum loss occurs when the WTI price dives below spot commodity prices at expiration.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?