Crude oil markets linger to focus on the consequences of Hurricane Harvey, as the hurricane turned tropical storm forces the closure of several refining plants and import/export terminals along the Texas and Louisiana coast.

U.S. refinery capacity shut On account of Tropical Storm Harvey, crude prices were affected by demand concerns. Brent relieved 10 cents to $50.65 a barrel from the day low of $50.55, while WTI crude dropped 10 cents to $45.92 from the day highs of $46.02 levels. At $5.60, front-month Brent/WTI spreads are at their highest levels since the 2015 summer. On options, WTI short-dated options grew richer by up to 1-2 vegas compared with the previous week, with 3-month at the money implied volatilities now hovering around 30%.

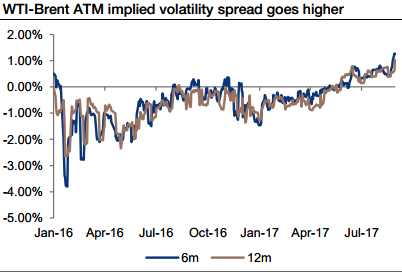

WTI-Brent implied volatility spreads rose to their highest level in more than a year, accelerating a trend that has been slowly developing over the first half of 2017 (refer above chart). 6 and 12 months ATM implied volatilities currently price WTI options 1.06 and 1.26 implied volatility points above Brent options. In the wake of the hurricane, this increase is justified for short-dated options. Indeed, as demand for crude oil collapsed this week, WTI crude oil prices have fallen significantly compared to the Brent benchmark.

Going forward, however, we doubt these levels can be sustained for long-dated options, and we expect Brent-WTI implied volatility spreads to converge back. It is still unclear what the short-term impact of the storm will be on refinery capacity, but we believe that, as the infrastructure gradually comes back online, as the floods retreat and logistics are restored, bearish sentiment on WTI should ease relative to Brent. This, of course, is barring any surprises or unexpected negative outcome persisting beyond normal recovery time.

Furthermore, at these levels, WTI prices have already been significantly corrected while Brent prices will suffer a seasonal slowdown in the coming weeks. Finally, US producer hedging, often in the shape of zero-cost collars and three-ways, should weigh on the at the money WTI implied volatility levels while lifting the wings.

Amid ambiguity about the lasting damage of the hurricane is lifted, tactical investors could be drawn to selling long-dated (>6m) WTI ATM implied volatility and buying Brent ATM implied volatility. Courtesy: Societe Generale

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?