USDCAD had a volatile month on mixed news flow and data, but ultimately positive signaling from Trump and a broadly weaker dollar pushed the pair to new lows since last September. While GDP, headline trade, and PMIs were all printed strong in the past month, the data points most relevant to central bank policy reinforce that risks still remain dovish.

Inflation has continued to surprise on the downside, with core printing 0.4%-pt below the 2% target for the second month in a row (refer above chart), as FX pass-through has faded.

Meanwhile, non-commodity exports, a focus for the BoC as an indication of a lack of structural competitiveness and signal of incomplete rebalancing, continue to disappoint, printing the largest year-on-year decline since 2010 (refer above chart).

Hence the ongoing dovish stance from BoC which indicated in January’s policy meeting and press conference, that a rate cut “remains on the table” -a signal that drove an 2.5% intra-week rally in USDCAD.

This rally was ultimately snapped by a series of headlines suggesting a constructive rather than confrontational approach from the Trump administration to the US-Canada relationship.

Hedging Strategy (USDCAD):

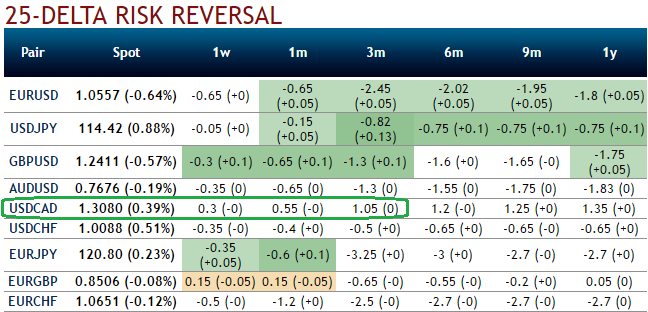

Well, amid higher vols in circumstances of USDCAD in 3m tenors, if you think vanilla structures are risky ventures, options spreads like positions are more conducive as the underlying spot FX is still hovering around all-time highs. The traders tend to view the call ratio back spread as a bullish strategy because it employs calls. However, it is actually a volatility strategy. Synchronizing both risk reversals and IV skewness of 3m tenors while we uphold longs via ATM calls in below options strategy to hedge the upside risks of this underlying pair.

So entering the position when implied volatility is high and waiting for the inevitable adjustment is a smart approach, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a “price neutral” approach to options and one that makes a lot of sense.

Hence, we advocate initiating 2 lot of 3m ATM +0.51 delta call, simultaneously, short (0.5%) ITM call of 1m expiries. One could achieve positive cashflows as the underlying spot keeps spiking.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data