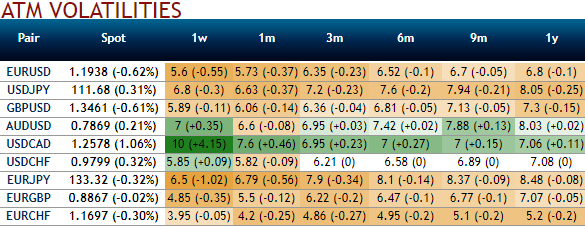

Before we move onto the core part of this discussion, let’s glance through above nutshell that evidences decimated ATM IVs of G10 FX space.

Under depressed vols circumstances, buying USDJPY puts is paying for the negative skew of low strikes. As it is seen that the underlying spot FX unlikely to collapse below 100, we do not need to buy the full downside. So, we also finance our puts by selling the downside skew via put spreads.

In setting a topside knock-in, near-term, USDJPY should be initially mildly supported by mounting US yields. This suggests conditioning medium-term put spreads by a topside knock-in. Such a barrier will cheapen the vanilla trade, as the bearish skew discounts the market-implied probability of bullish moves.

It is impossible to pinpoint flows in an opaque OTC market that might be responsible, one could surmise with a little more assurance that back-end yen vega was a crowded long position in vol portfolios for the same reasons that we had flagged it in the first place, and also perhaps in directional format via USD call spreads/digitals as carry friendly bearish US rates proxies; it is not unreasonable to think that the latter has seen some towel-throwing of late as USDJPY spot has stubbornly resisted the upward pull of higher Treasury yields.

The difficulty of neat return attribution in this instance presents a dilemma: known drivers of the constructive yen vol view have not fundamentally changed in a way to justify re-assessing – if anything, these are excellent levels to reload longs – yet the possibility of ongoing flows continuing to hurt vega owners and leading to further stop outs cannot be entirely discounted.

We will take another stab at bottom picking USDJPY 1Y ATM vol in the mid/high7s if we get there when the 1Y/1MM vol curve might have steepened closer to 5-yr extremes. In the meanwhile, our proxy exposure to higher yen vols would be limited to cross-yen vs. USDJPY vol spreads that also cover other bases (e.g. GBPJPY – USDJPY as a Brexit play or CADJPY – USDJPY that acts as a NAFTA hedge).

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings