Option basket: USDCHF Bull call spread

Overview: bullish in medium term

On speculating grounds we tend to buy USD/CHF At-The-Money binary puts for targets of 20 pips as the pair breaking major support 0.9240 and has dropped upto 0.9236 levels. Currently trading at 0.9240, short term trend is weak as long as resistance 0.9250 holds.

But on hedging front the recommendation would be bullish bias.

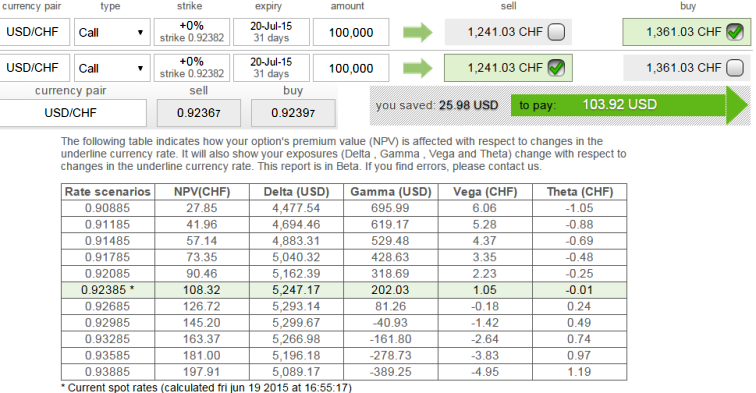

Add 1M longs on An-The-Money calls which are available at delta 0.49 + Write another Out-Of-The-Money call with positive theta value and 0.5% higher strike price with the same maturity for a net premium payable.

The combined position should have delta value as shown in the diagram. Theta is almost 0 which is still acceptable as we formulated position in 1:1 proportion.

This is worth using a Call Spread over a long naked call when the cost of the long call is too high and the underlying currency is expected to move somewhat higher.

Credit from short call reduces the cost of long call.

FxWirePro: Use USD/CHF debit spreads for hedging and binary puts for speculation

Friday, June 19, 2015 12:14 PM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings