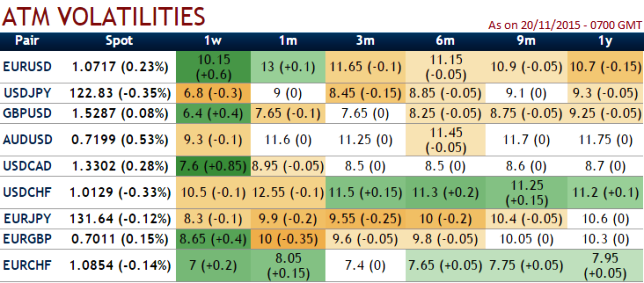

As you can see from the nutshell showing implied volatilities of ATM contracts (EURUSD of next month's expiries show 11.75% which is the highest among G20 majors).

We recommend on speculation basis buying one touch vega puts in order to extract leverage on extended profits.

Employing these Vega options would determine exponential returns as IV gradually increases or even pour returns unimaginably but also upbeat the implied volatility.

But do remember this call is strictly on speculative grounds on hedgers stay away.

The prime merits of such one touch option spreads are high yields during high volatility plays. Wider spreads indicates lack of liquidity.

The spreads for one touch EUR/USD options are constant time and barrier levels. We believe one touch Vega spreads can be the best suitable options to trade HY vols.

Usually, such binary options for every change in 1 pip the relative change in option price 0.01% or even exponential at high implied volatility times.

On hedging grounds, as fed fund futures already pricing about a 70-80% chance of a hike this year, we would expect a modest upward move in the USD as the market fully prices in December as the lift-off date, we would prefer put ratio back spreads in the ratio of 3:1.

FxWirePro: Use EUR/USD vega binary puts to trade on HY vols

Friday, November 20, 2015 9:13 AM UTC

Editor's Picks

- Market Data

Most Popular