Euro area business and consumer surveys point to solid growth momentum in the region. Sentiment improved significantly during Q4’16 and remained robust in January. Consistent with this signal, Euro area GDP increased a solid 2% QoQ SAAR in Q4’16 and was revised up for Q3 in the flash GDP report, published almost two weeks ago.

In Eurozone, the consumer confidence printed at -4.9 in Jan which is a high dating back to early 2015. Consumer confidence gained some momentum in late 2016 after a poor start to the year and a downturn around Brexit. Though recent GDP and manufacturing surveys have been more positive, given the ongoing political uncertainty that foreshadows 2017, it is difficult to see the index strengthening much further.

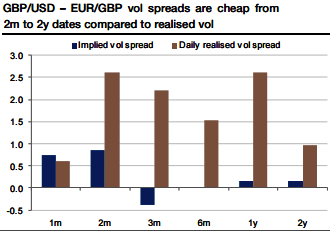

EUR risk prompts to pick the 6m tenor via volatility, the spread is the cheapest on the 3m and 6m tenors (see above graph). 3m contracts now encompass the French presidential election. We expect volatility disruptions ahead of the risk event to be potentially significant but short-lived.

All in all, a short-lived volatile period will be more effectively diluted in selling that premium over a 6m rather than a 3m vol contract, via a larger number of fixings. However, this is still a tail risk, so we prefer implementing the trade via volatility swaps rather than variance swaps (more painful if the unity of the euro area crumbles).

Go long GBPUSD vs EURGBP 6m volatility swaps @ 0.3 vols, indicative offer; same GBP notional in both legs. The vega MTM is roughly proportional to the implied vol spread and its odds are even more attractive than the realized vol odds, which reflect the odds of the payoff at expiry (see distribution chart on above graph for realized vols).

Indeed, the trade valuation will benefit from any widening of the implied spread from its almost flat level (a March hike surprise would definitely shake cable more than EURGBP).

So we recommend unwinding the package in the event of early vega profit, especially if it happens before the French election.

Risk profile: A durable surge in EUR crosses vols, a spread of volatility swaps is exposed to the volatility differential between two currency pairs. Investors holding the position until the 6m expiry face unlimited losses if the realized volatility between GBPUSD and EURGBP goes below 0.3 vols.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure