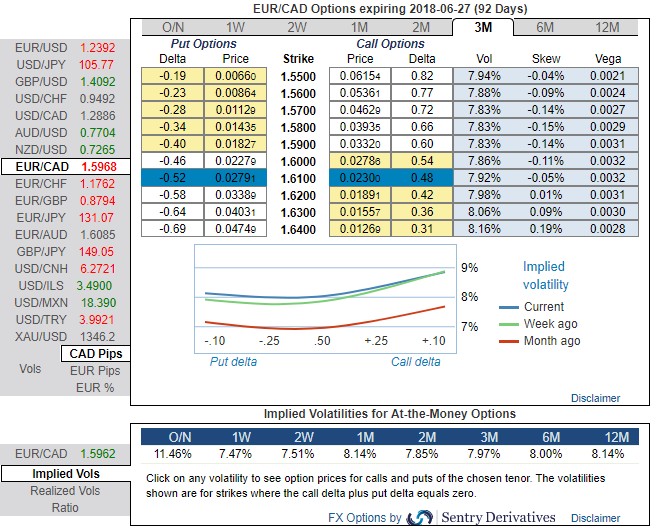

Large options set to constrict the range. The EURCAD appreciation seems to be sluggish than it has recently been as the CAD likely to get cushion on crude price support, while the skew is still undecided whether volatility should rise on the back of a higher or lower spot (refer above nutshell evidencing positive IV skews stretched towards OTM calls for strikes upto 1.64 but with lower IVs a tad below 8%).

There is also a case to be made for the long leg to be comprised of a mix of EURUSD and a petro-sensitive EUR-cross such as EURCAD to strip out the oil price sensitivity of the structure.

EURCAD vols also have the advantage of very little risk premium priced into them having reversed more than 100% of their VIX-spike gains per above chart, and can also potentially benefit from idiosyncratic NAFTA-related stress.

Contemplating above factors, we had already initiated below-mentioned option structures, for now, we continue to hold on to the same positions.

An equally weighted basket of 6M EURUSD and EURCAD straddles (€85K vega each) vs. selling €100K vega of 6M 30D EUR calls/RUB puts.

The RV is better expressed in longer expiries (6M – 1Y) than in short dates since the implied –realized premium in RUB widens as one goes further out the curve, and also because the belly of the curve is the best value sector of the EURUSD surface to buy.

Currency Strength Index: FxWirePro's hourly EUR spot index has shown 74 (which is bullish), while hourly USD spot index was at 97 (bullish), CAD is flashing at -24 (mildly bearish) while articulating at 12:07 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data