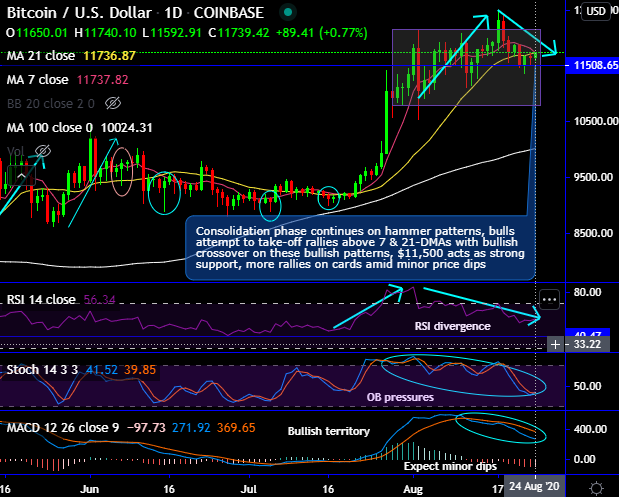

Bitcoin price rebounds at $11,370 mark, the bullish price action has been impressive since Covid-19 saga. But for now, the bulls seem to have been drifting in sideways sensing stiff resistance of $12,400 - $12,500 levels.

BTCUSD (at Coinbase) has decelerated bullish price momentum and plunges below 12,000 areas again that indicates the consolidation is likely to prolong ahead of a breakout to $12,500 levels.

Prior to which, bulls are roaring with the fresh 1-year highs after decisive breakout of long-lasting range with the stern bullish candle on 17th (refer daily chart), technically, both leading & lagging indicators are also in line with the prevailing upswings with mild overbought pressures. But currently, the strong support is seen at 11,500 levels.

On a wider perspective, BTC has spiked since mid-March, from $3,858 to the current highs of $12,486 which is 226% rallies. The major trend has also broken out of the range and retraced more than 50% Fibonacci levels of December 2018 lows to the all-time highs in 2017 (refer weekly plotting).

Along with such an upsurge in the underlying price action, Bakkt, the ICE’s subsidiary, has made commendable record numbers of trades for its monthly Bitcoin futures contracts as BTC prices is surging higher above $11,000 mark, so is the case with CME BTC futures.

Although we expect minor dips in the short run, but long hedges should be intact as the major bull-run is foreseen.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different