The US dollar and bond yields pulled back after some weak US data. Equities remained elevated, though, the DJIA making a fresh record closing high.

We see positive momentum remains intact, 0.7640 the immediate target area.

AUDUSD medium term perspectives: The resilience of US equity markets to the distractions of the Trump administration is a positive backdrop for risk-sensitive AUD. Chinese markets are of course less helpful as the deleveraging push continues, but the uptrend in steel prices suggests the potential for recovery in iron ore prices. The rebound in Australian job creation keeps RBA rate cut talk at bay. But multi-month, we expect the ongoing rise in US interest rates to chip away at AUDUSD, leaving it around 0.73 by Q3.

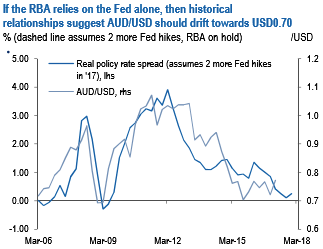

We expect AUDUSD to decline further through 2017 on skinnier rate differentials and weaker terms of trade profile. Our Dec-17 target remains USD 0.71. By 2Q’18, we forecast AUD to USD0.67; even if the RBA does not deliver easing in 2H’17, two more hikes from the Fed in 2017 will still leave minimal carry support for AUD (refer above chart), which is particularly important given its vulnerability to a turn in China’s momentum or adverse developments in global trade.

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal