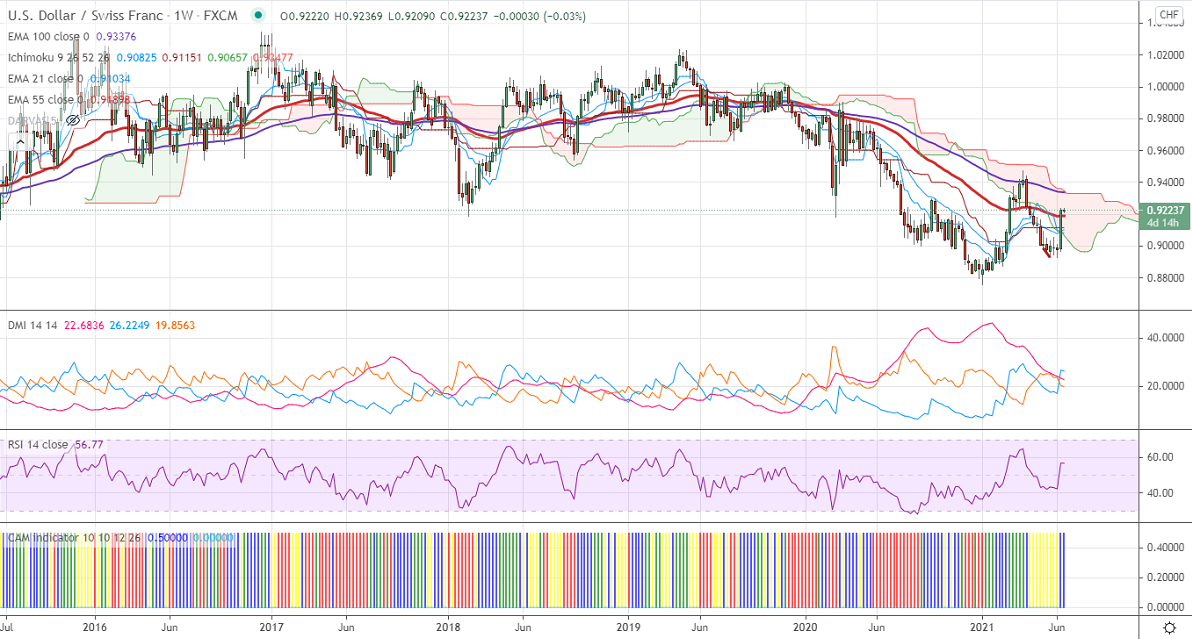

Ichimoku analysis (Weekly chart)

Tenken-Sen- 0.90825

Kijun-Sen- 0.91150

USDCHF is trading extremely higher and jumped more than 250 pips on board-based US dollar buying. US dollar index was one the best performers the previous week on hawkish Fed policy. The US bond yields pared most of its gains made after the US Fed and lost more than 15%. The pair is holding well above 0.9200 and hits an intraday high of 0.92369.

Short term outlook:

Trend- Bullish

The pair is holding above weekly Kijun-Sen, Tenken-Sen, and the cloud. The near-term resistance is around 0.92500. Any indicative break above will take the pair to next level to 0.9300/0.9340. On the lower side, near-term support is around 0.9180. Any convincing breach below targets 0.9120/0.9080. Significant selling will happen only if it breaks 0.8920.

Indicator (Weekly chart)

CAM indicator – Bullish

Directional movement index –Bullish

It is good to buy on dips around 0.9180 with SL around 0.9120 for TP of 0.9300.