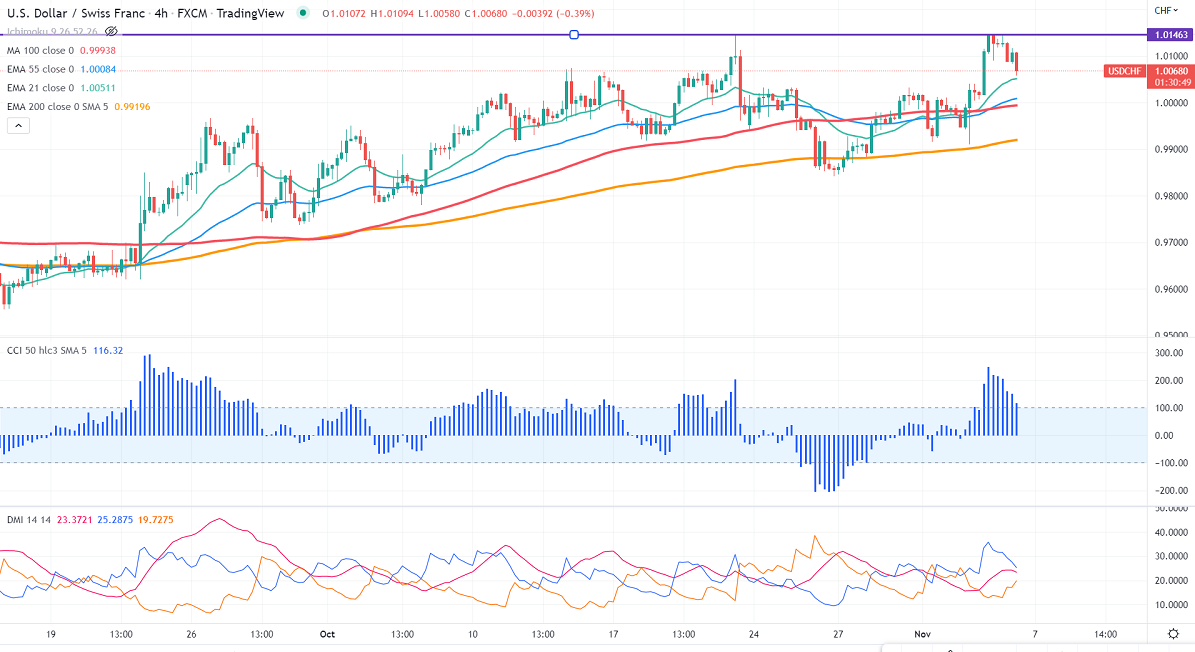

Chart pattern- Double top

USDCHF has formed a double top near 1.0150 and shown a minor sell-off. The pair lost after the Swiss National bank Chairman said that the central bank may need to hike rates often to cool down inflation. It hits a low of 1.00619 and is currently trading around 1.00609.

The US ISM services index fell to 54.40 last month, the lowest reading in 2-1/2 years. The number of people who have filed for unemployment benefits dropped to 217000 last week, compared to a forecast of 220K.

The US 10-year yield declined more than 2.5% after forming a minor top around 4.221%. The US 10 and 2-year spread widened to -60 basis points from 23.9- bpbs.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Dec increased 48% from 34.10% a week ago.

Technically in the 4-hour chart, the pair is holding above short-term (21 and 55 EMA) and long-term 200 EMA (0.99180). Any break below 1.0050 confirms further bearishness, a dip to 1/0.9960 is possible. It hits an intraday low of 1.00580 and is currently trading around 1.00649.

The near-term resistance is around 1.0150 and any breach above targets is 1.020/1.0250. Significant trend continuation only if it breaks 1.0150.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- Neutral

It is good to sell on rallies around 1.0100 with SL around 1.0150 for the TP of 1/0.9960.