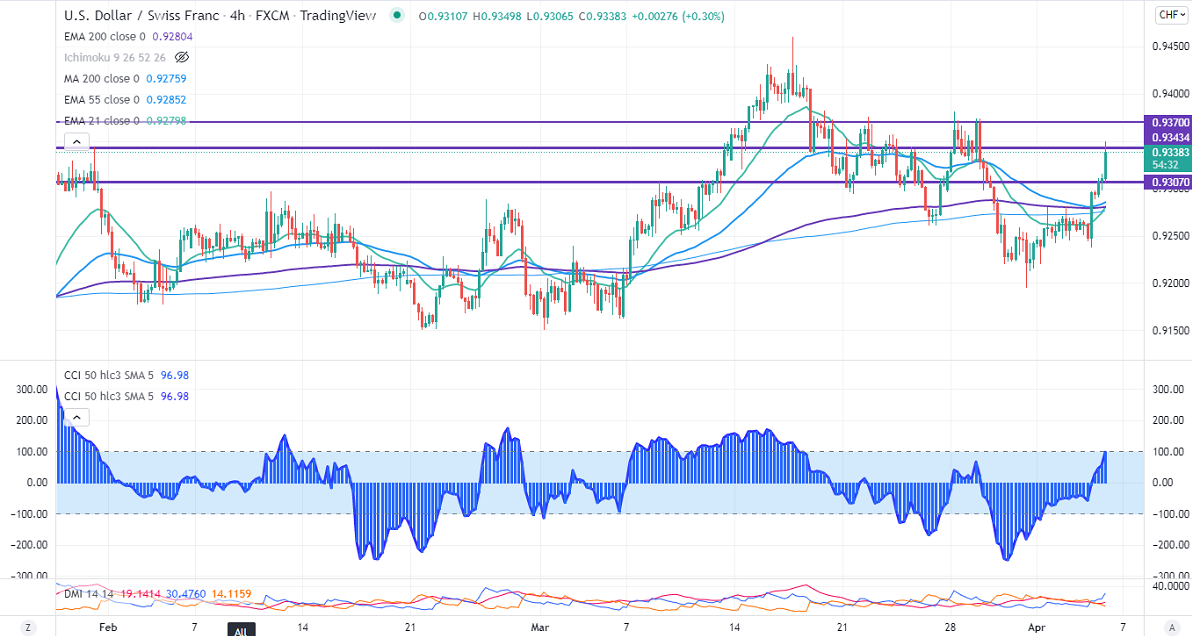

The pair regained sharply on board-based US dollar buying. Hawkish comments from Fed Governor Lael Brainard and San Francisco Fed President Mary Daly support the US dollar at lower levels. Markets eye US Fed meeting minutes for further direction. It hits an intraday low of 0.93498 and is currently trading around 0.93424.

US ISM services PMI increased to 58.3 in Mar vs. the forecast of 58.40.

Bullish scenario-

The primary level to Watch – is 0.93800. Any convincing surge above confirms intraday bullishness. A jump to 0.9435 is possible.

Bearish scenario-

Intraday support – 0.9300. Break below that level will take the pair to 0.9260/0.9200/0.9150/0.9090.

Indicators (4-Hour chart)

Directional movement index – Bullish

CCI (50) - Bullish

It is good to buy on dips around 0.93200 with SL around 0.9270 for a TP of 0.94350.