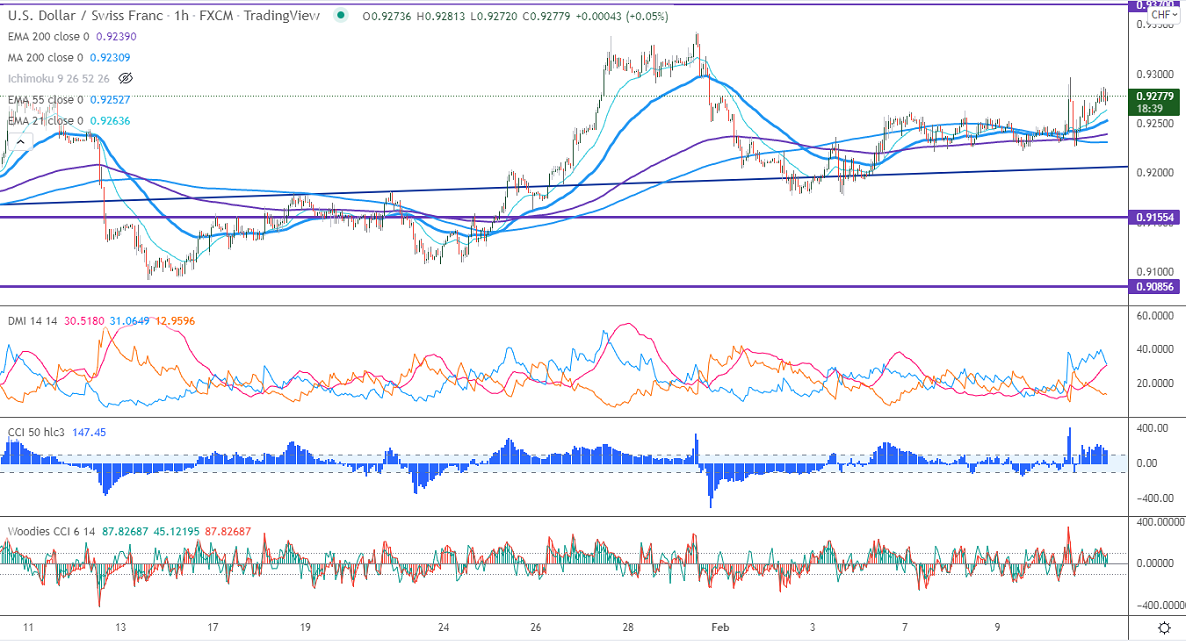

Intraday trend – Bullish

Significant intraday resistance – 0.9300

The pair gained above 0.9250 on upbeat US CPI data. . The January US CPI came at 7.5% YoY vs forecast of 7.3%, the highest level since Feb 1982. The US 10-year yield surged above 2% for the first time since Aug 2019. USDCHF hits a high of 0.92870 at the time of writing and is currently trading around 0.92798.

Bullish scenario-

The primary levels to Watch – 0.9300. Any convincing surge above confirms intraday bullishness. A jump to 0.9341/0.9380/0.9435/0.9500 is possible.

Bearish scenario-

Intraday support – 0.92450. Break below that level will take the pair to 0.9170/0.9090/0.9050.

Indicators (4-Hour chart)

Directional movement index – Bullish

CCI (50) - Bullish

It is good to buy on dips around 0.9258-60 with SL around 0.9200 for a TP of 0.9365.