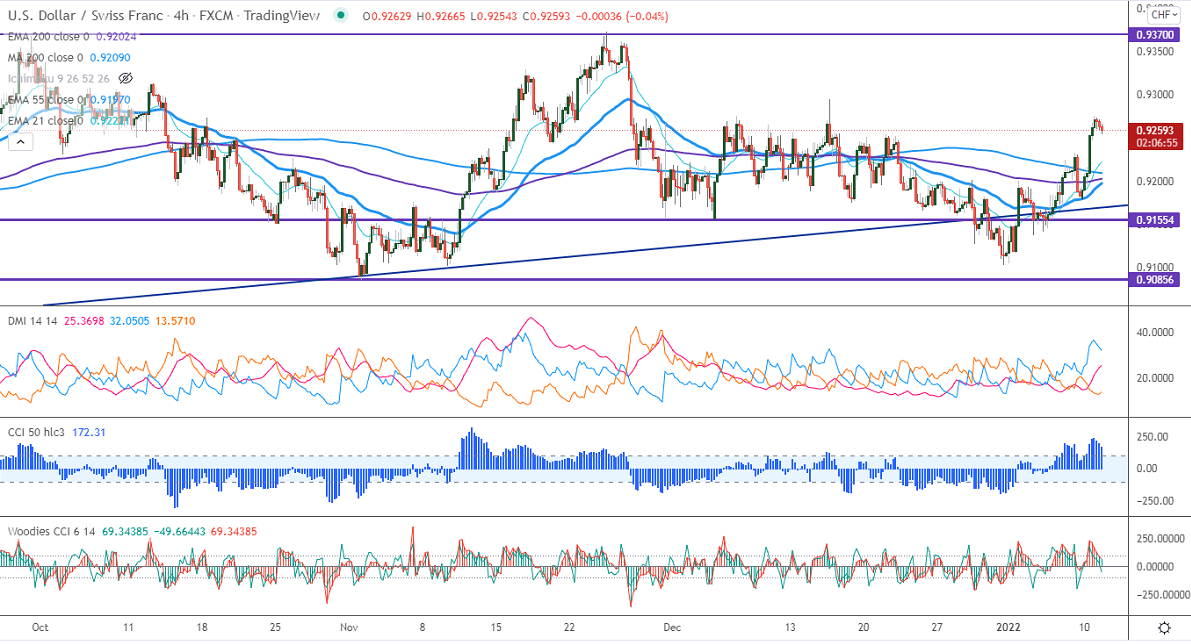

Intraday trend – Neutral

Significant intraday support – 0.9200

The pair regained sharply more than 150 pips this year on board-based Swiss franc weakness. The upbeat risk sentiment has decreased demand for safe-haven assets like the Swiss franc. Markets eye Fed Chairman Powel testimony for further direction. It hits an intraday low of 0.92543 and is currently trading around 0.92573.

Bullish scenario-

The primary levels to Watch – 0.92750. Any convincing surge above confirms intraday bullishness. A jump to 0.9300/0.9330/0.9380 is possible.

Bearish scenario-

Intraday support – 0.9200 (200-4H EMA). Break below that level will take the pair to 0.9150/0.9090/0.9050.

Indicators (4-Hour chart)

Directional movement index – Bullish

CCI (50) - Bullish

It is good to buy on dips around 0.92150-80 with SL around 0.9170 for TP of 0.9330.