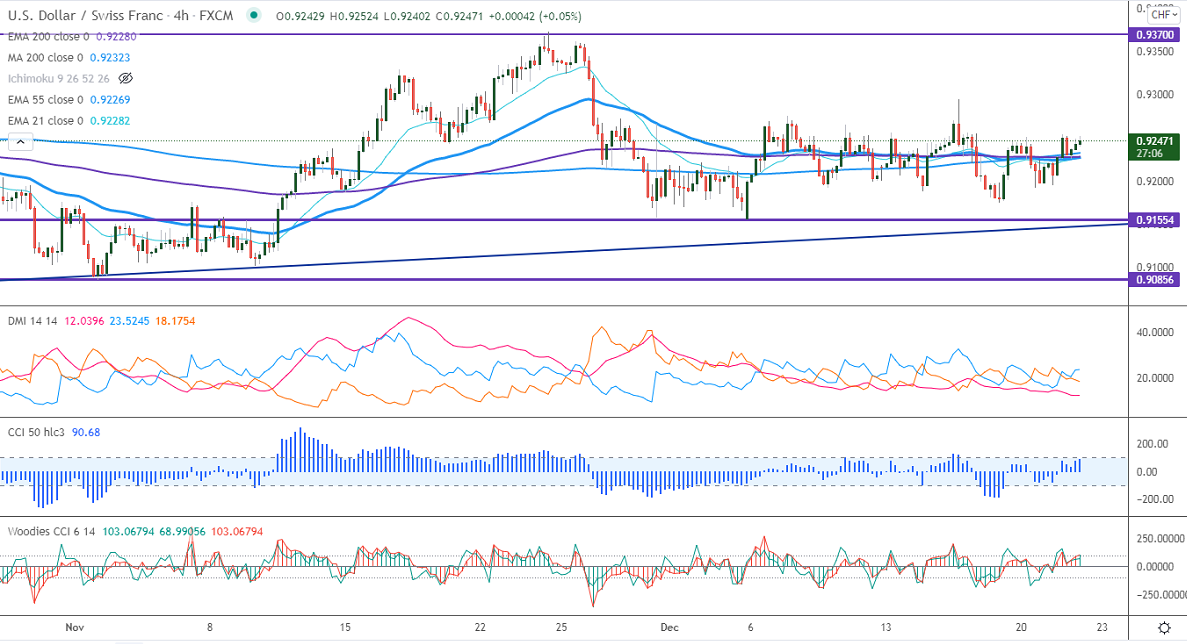

Intraday trend – Neutral

Significant intraday resistance – 0.9300

The pair has traded in a narrow range between 0.91745 and 0.92540 for the past three days. The hopes of a rate hike by the Fed and surge in US treasury yields are supporting the US dollar at lower levels. Markets eye US Conference Board consumer confidence and existing home sales for further direction. It hits an intraday high of 0.92524 and is currently trading around 0.92491.

Bullish scenario-

The primary levels to Watch – 0.9300. Any convincing surge above confirms intraday bullishness. A jump to 0.9330/0.9380 is possible.

Bearish scenario-

Intraday support – 0.9170. Break below that level will take the pair to the Nov month low 0.91574. Significant trend reversal only if it breaches 0.9150. Minor support is 0.9230.

Indicators (4-Hour chart)

Directional movement index – Neutral

CCI (50) - Bullish

It is good to stay away till further direction.