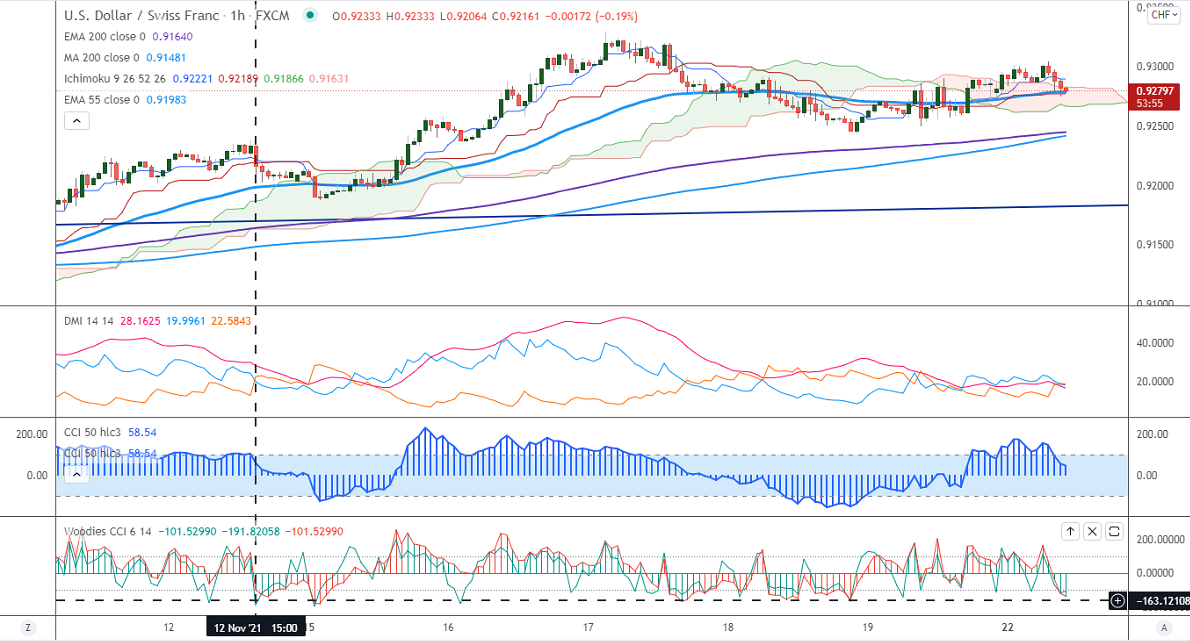

Major resistance -0.9375

Intraday support- 0.9240

The pair Has declined after a minor pullback above 0.9030. The intraday trend is bearish as long as resistance 0.9330 holds. The rebound in the US dollar index is supporting the pair at lower levels. The hopes of a rate hike by the Fed in mid-2022 is pushing the US dollar higher. USDCHF hits an intraday low of 0.92761 and is currently trading around 0.92775.

Woodies and CCI analysis-

The CCI (50) is holding above zero line and Woodies CCI is below zero lines in the hourly chart. It confirms the trend is neutral.

Trend- Neutral

USDCHF is facing strong resistance around 0.9375. Any break above targets 0.9400/0.9450 is possible. The minor resistance to be watched is 0.9330. On the lower side, immediate support is around 0.9240. Any convincing breach below targets 0.9180/0.91350.

Indicator (1-hour chart)

Directional movement index - Neutral

It is good to buy on dips around 0.9245-48 with SL around 0.9200 for a TP of 0.9330.