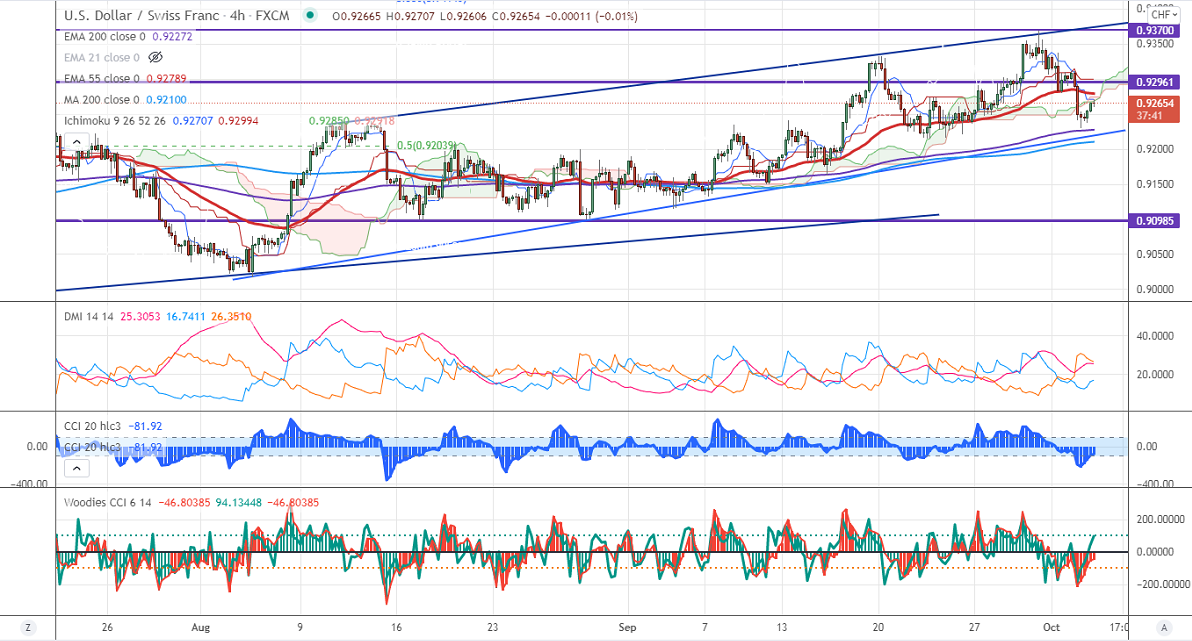

Major Intraday resistance -0.9320

Intraday support- 0.92350

The pair has taken support near 200-4H EMA and shown a minor pullback. It has halted its one and half month's bullish trend at 0.93680 (trend line resistance). The intraday trend is still neutral as long as support 0.92150 holds. The risk aversion in the global markets has increased demand for Safe-haven assets like the Swiss franc. The US dollar index is trading below 94 levels, any breach below 93.60 confirms intraday bearishness. At the time of writing, USDCHF is hovering around 0.92658 up 0.22%.

Woodies and CCI analysis-

The Woodies CC and CCI (50) are trading below zero lines (bearish trend).

Trend-Neutral

USDCHF is facing strong resistance around 0.92794 (55- 4H EMA). Any break above targets 0.9330/0.93685. It should surge past 0.9370 for further bullish continuation. A jump to 0.9400/0.94725 is possible. On the lower side, immediate support is around 0.92350. Any convincing breach below targets 0.92150/0.9180.

Indicator (1-hour chart)

Directional movement index - Neutral

It is good to wait until clear direction.