Ichimoku analysis (1 Hour chart)

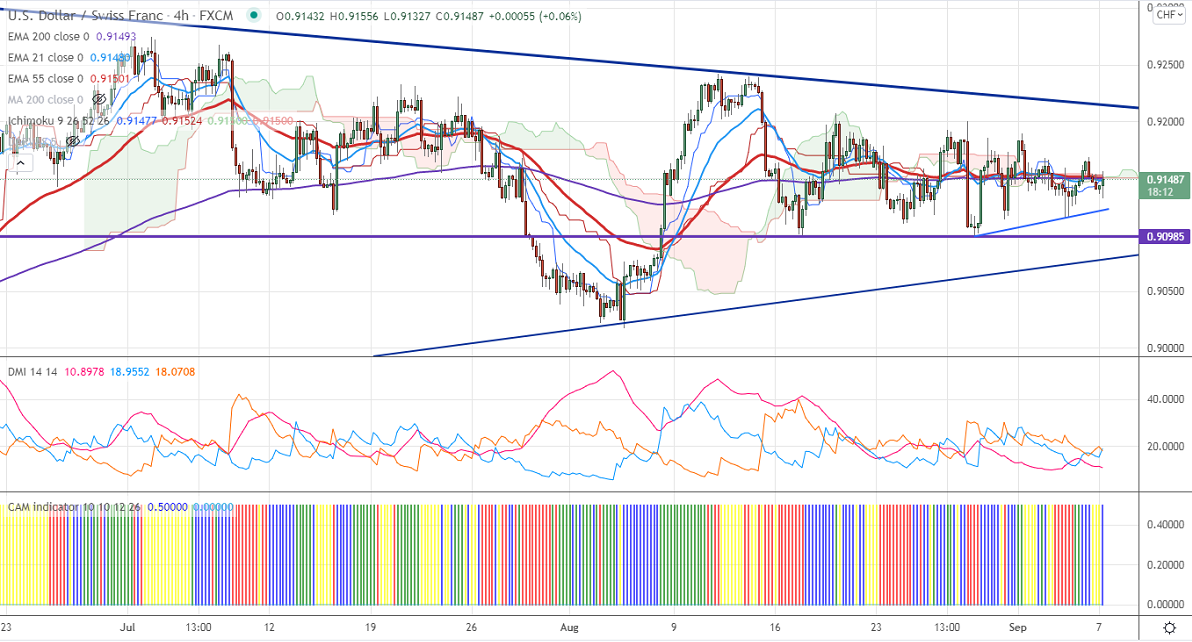

Tenken-Sen- 0.91471

Kijun-Sen- 0.91524

June month high– 0.92750

The pair is trading in a narrow range between 0.9100 and 0.91997 for the past two weeks. The US dollar index has started to recover from a low 91.94 made after dismal US jobs data. Any breach above 92.50 confirms intraday bullishness. At the time of writing, USDCHF is hovering around 0.91507 up 0.05%.

Trend-Neutral

The near-term resistance is around 0.9170, any breach above targets 0.9200/0.92180 (trend line resistance) 0.9240/0.9275. The decline from 0.94725 will get completed if it breaks 0.92750. On the lower side, immediate support is around 0.91150. Any convincing breach below will take to the next level 0.9995/0.90750/0.9050.

Indicator (Hourly chart)

CAM indicator –Neutral

Directional movement index –Neutral

It is good to avoid until getting clear direction