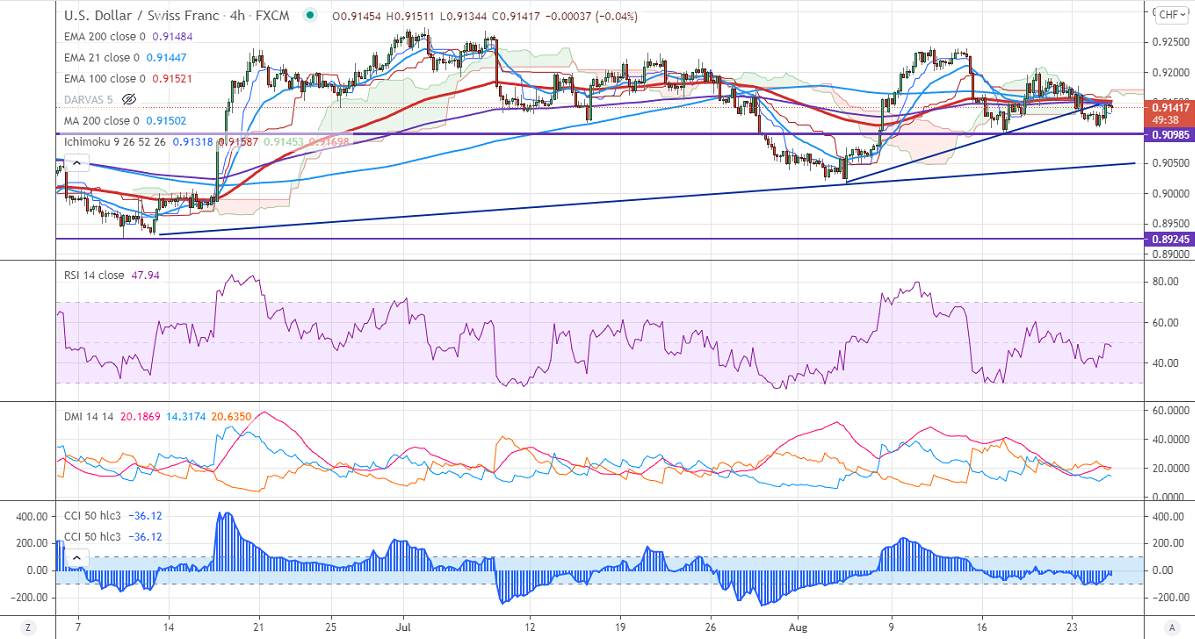

Ichimoku analysis (4 Hour chart)

Tenken-Sen- 0.91318

Kijun-Sen- 0.91587

June month high– 0.92750

The pair is consolidating between 0.92069 and 0.91105 for the past two days. The minor sell-off in the US dollar is putting pressure on this pair at higher levels. The US new home sales surged by 1% in Jul to a seasonally adjusted annual rate of 708000 units compared to a forecast of 698000. The US 10-year yield surged after approval of Pfizer vaccine approval. At the time of writing, USDCHF is hovering around 0.91400, up 0.16%. Markets US durable goods orders for further direction.

Trend- Bearish

The near-term resistance is around 0.91563 any breach above targets 0.9185/0.9210/0.9240/0.9275. Bullish trend continuation only if it breaks 0.92750. On the lower side, immediate support is around 0.91150. Any convincing breach below will take to the next level 0.90750/0.9050.

.

Indicator (4-Hour chart)

CCI (50) – Bearish

Directional movement index –Bearish

It is good to sell on rallies around 0.9138-40 with SL around 0.9180 for a TP of 0.9000.