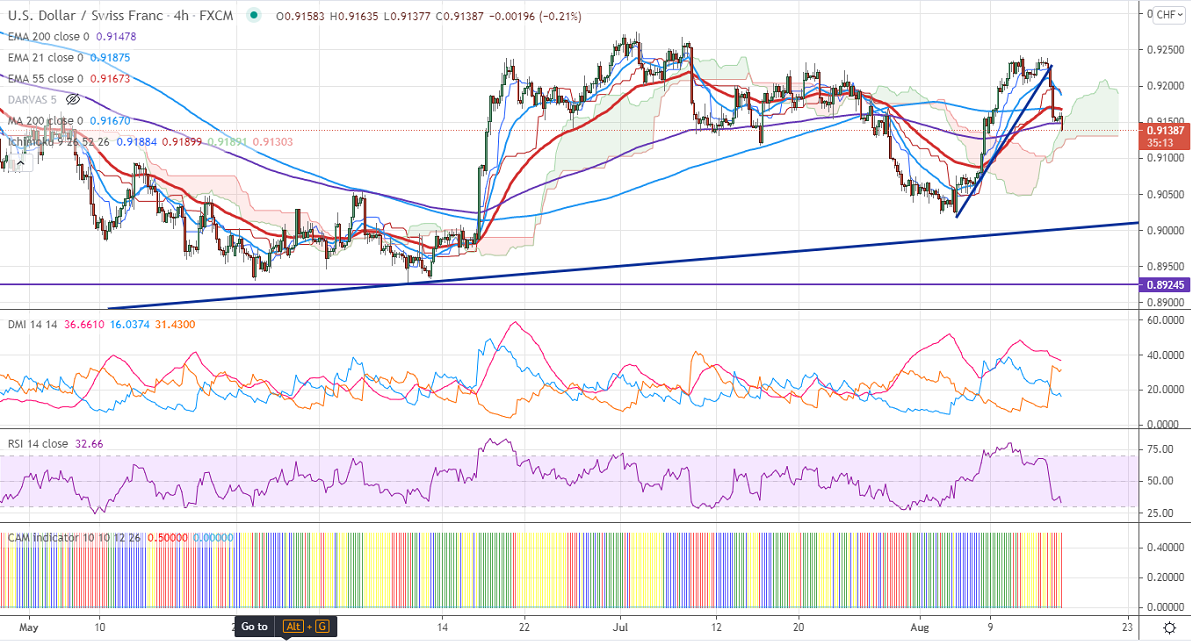

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 0.91941

Kijun-Sen- 0.91953

June month high– 0.92750

The pair has declined sharply after a minor pullback above the 0.9230 level. The dismal US consumer confidence has dragged the US dollar down. The University of Michigan consumer sentiment declined sharply to 70.20 for Aug, the lowest level since 2011. The US 10-year yield lost more than 5% after the data. At the time of writing, USDCHF is hovering around 0.91440 down 0.08%.

Trend- Bearish

The near-term support is around 0.9115, any breach below targets 0.9070/0.9050. Bearish trend continuation only if it breaks 0.8925. On the higher side, immediate resistance is around 0.9185. Any convincing breach above will take to the next level 0.9240/0.92750.

.

Indicator (4-Hour chart)

CAM indicator –Bearish

Directional movement index –Neutral

It is good to sell on rallies around 0.9158-60 with SL around 0.9200 for a TP of 0.9070.