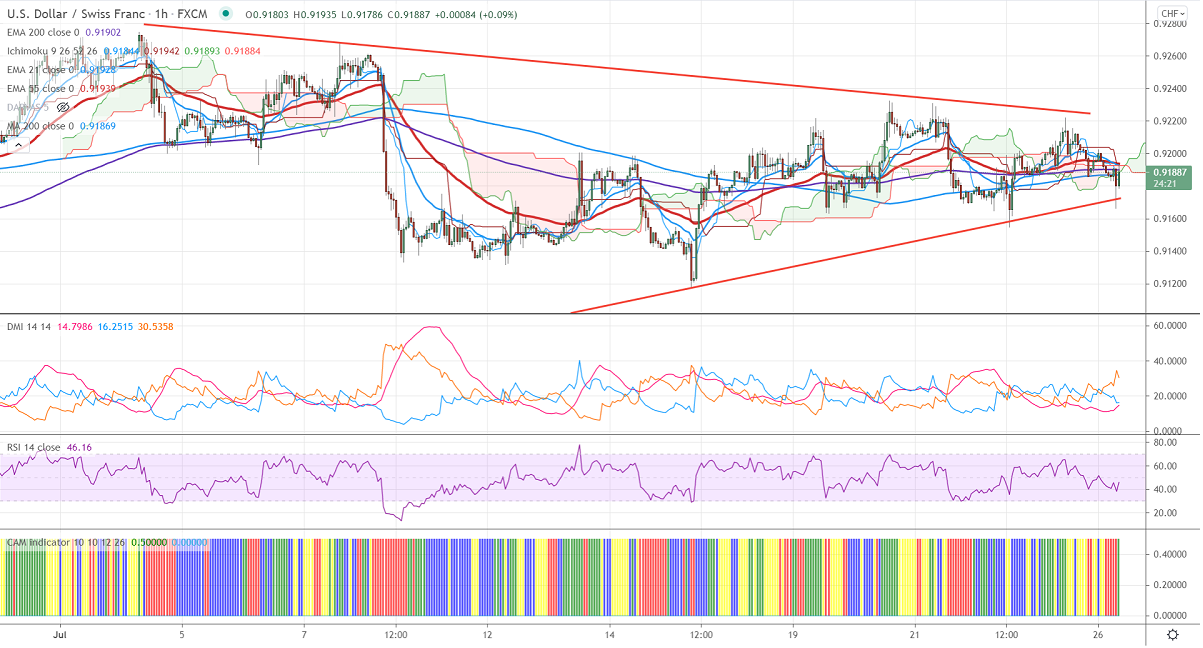

Ichimoku analysis (4-hour chart)

Tenken-Sen- 0.91844

Kijun-Sen- 0.91942

This week High– 0.92326

Previous week low- 0.91330

The pair is consolidating for the past four weeks between 0.92745 and 0.91176. The pair has once again declined after a minor jump above 0.9200. The overall trend is bearish as long as resistance 0.92750 holds. Any breach below 200-4H MA confirms further bearishness. The Markit US manufacturing and services PMI have fallen to a 4-four month low of 59.8 from 64.6.USDCHF hits an intraday low of 0.91664 and currently trading around 0.91893.

Trend- Neutral

The near-term support is around 0.9150, the breach below will take the pair to 0.9120/0.9059/0.9000. On the higher side, immediate resistance is around 0.92380. Any convincing breach above targets 0.92750/0.93000.

Indicator (1 Hour chart)

CAM indicator – Bearish

Directional movement index –Neutral

It is good to buy on dips around 0.9170 with SL around 0.9130 for a TP of 0.9270.