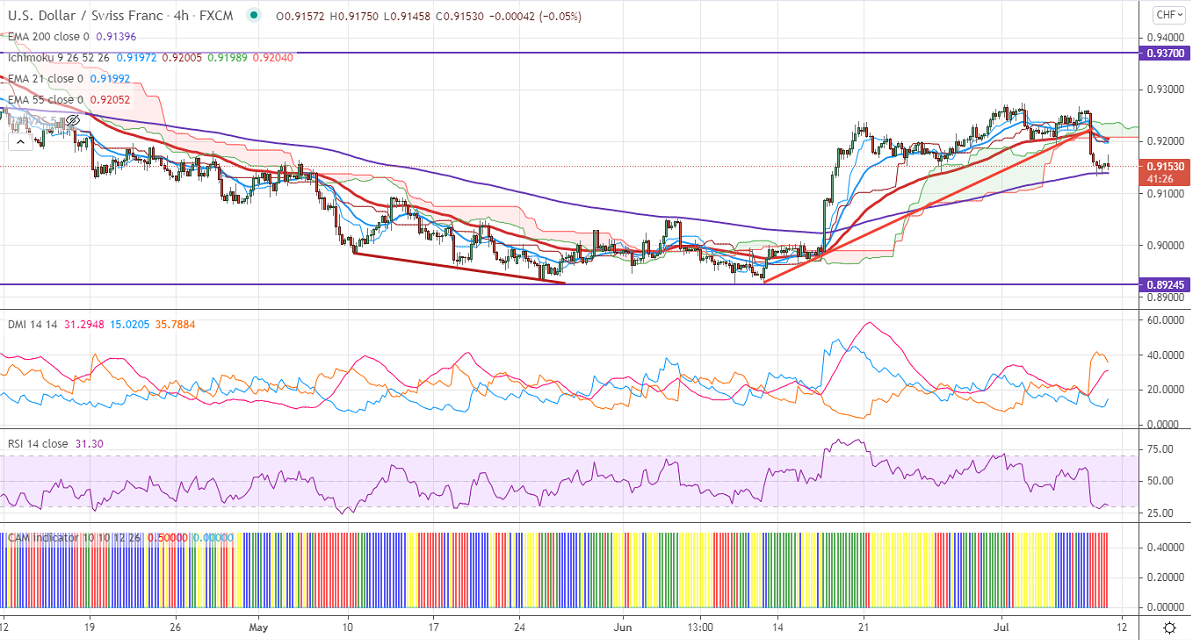

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 0.91972

Kijun-Sen- 0.92005

Previous week High– 0.92748

The pair has slumped sharply more than 100 pips on the strong Swiss franc. The safe-haven yen and Swiss franc surged yesterday after the spread of the new delta variant virus all over countries. The global stock markets plummeted as the new corona variant might affect the global economy. The intraday bias is bearish as long as resistance 0.92750 holds.

Trend- Bearish

The near-term support is around 0.9150, the breach below will take the pair to 0.9125/0.9090. On the higher side, immediate resistance is around 0.9180. Any convincing breach above targets 0.92160/0.9238/0.92750.

Indicator (4 Hour chart)

CAM indicator – Bearish

Directional movement index –Bearish

It is good to sell on rallies around 0.91580-60 with SL around 0.9210 for a TP of 0.9050.